Well folks, I’m back. Did you miss me? I decided to take a couple of weeks off from blogging since I figured what could possibly happen in the time between my last Blog about – what was it? Naughty or nice lists? Christmas movies? I don’t remember – and now.

Well, I was apparently wrong. But really, who in the world could have predicted that chaos, pandemonium and assault on the norms of democracy that we saw on January 6th in Washington DC never mind the “Wide Right” Buffalo Bills qualifying for the NFL playoffs and winning the AFC East?

Well on the football side, it may have been obvious, but on the carnage side, did anyone really predict it?

Who am I kidding? One guy did. Back in December before I took my holiday break!

Don’t believe me?

Donald J Trump who tweeted this on December 18:

Peter Navarro releases 36-page report alleging election fraud ‘more than sufficient’ to swing victory to Trump. A great report by Peter. Statistically impossible to have lost the 2020 Election. Big protest in D.C. on January 6th. Be there, will be wild!

And then he tweeted this on December 27:

See you in Washington, DC, on January 6th. Don’t miss it. Information to follow!

So, one guy clearly knew what was going to happen. I’m thinking he could have warned law enforcement, but then again, they could have just gone on social media.

Look, I obviously don’t live in the United States, I hang my shingle in Canada where we have our share of wacky problems like sneaky globe-trotting politicians, so I don’t presume to sit in judgement.

The United States is a big, brash, cauldron of craziness that is constantly both fascinating and terrifying.

As a long-time observer, this election and its aftermath most certainly fits both those categories. The assault on the capitol by the unhinged mob was what can most charitably be described as the low point in both the electoral cycle and the Trump presidency. This, combined with the callous political opportunism on display by any number of politicians, is something that no observer has ever expected or wanted to see in the world’s longest functioning and, chaos aside, most robust democracy.

That said, these moments can often be self-correcting and we have seen that already start to happen as the Trump ship continues to take on water and the conscripts and rats jump off and swim ashore.

Looking at the tragic end of the Trump presidency I can’t help but be reminded that unlike a comedy where the fall from grace is sure to come once the story is over, a tragedy typically leaves nowhere to go but up, as far as story arcs go. Don’t believe me? Read any great Shakespearian tragedy. Start with King Lear.

So that’s good right? Of course it is. And I may write about that next week.

But this week, while I would like nothing better than to write about Trump and Kenney and elections and trips to Hawaii and Trudeau and O’Toole and Chiefs of Staff and Nenshi the mayor and that lady who took an all-expenses paid trip to Jamaica or the hospital CEO with the $1 million severance, I can’t.

And that’s because unfortunately I have to do my annual colonoscopy, which is the analysis of my last year’s Fearless Forecast and the delivery of a report card derived from it.

And it isn’t pretty.

Let’s get after it.

The following is an official report card, issued by a remote assessment, grading the full year results of the 2020 Fearless Forecast, which I officially renamed the “Dumpster Fire” since any and all sanity and substance has been wrung out of the peerless prognostications due to COVID, price wars, economic shutdowns and all the attendant chaos that has been the story of all of our lives since those heady and hopeful early days in January.

Just to recap, in Q1 I decided to just give myself a pass on all my forecasts because the world was just beginning to grasp the extent of the shutdowns. Then in Q2 I revised some numbers a bit as the economy started to open up. In Q3 I elected to assess relative to the market realities as economies around the world opened further. Finally, for the full year, I’m just straight up reporting.

Finally, since I did recast some of my general themes in light of the pandemic I will need to own it now and not give myself a free pass because of exogenous, black swan events.

Broad Themes

Interestingly, my original forecast posited that the theme of civil unrest would still be topical, but that the largest influence on the globe would be the runup to and the eventual result of the US Presidential Election. I also suggested that Trump 2.0 would run on his economic record as opposed to the nationalist side-show that underpinned the 2016 run.

In retrospect, this seems really naïve, but absent COVID, probably had a good base in reality.

Long story short, notwithstanding the pandemic, 2020 was going to be all about the US election, because the result will set the trajectory of the (as yet still) free world for the next four years. Clearly this was a prescient call. And an easy one.

When I made my forecast in January, I believed the US was already experiencing an economic downturn, which was confirmed by the US Fed which said the US was in a recession in February, prior to the pandemic.

Ironically and fortunately for Trump, the already faltering economy and his disastrous trade policies were a distant memory come election season.

Unfortunately for Trump, the pandemic was the primary election issue with systemic racism and white privilege being a close second. The cratering of the economy due to the pandemic is actually wrapped around all of these issues. I do not believe that there are many undecided voters in the United States who think that Trump had what it takes to right the ship.

On the civil unrest side, the domestic protests and violence were not a primary part of my forecast. However, it is always bubbling under the surface in the United States and in a world where Donald Trump uses all things race to fire up his base, you had to know that this was likely to come to the fore, even in a pandemic. I didn’t buy the “descent into fascism” rhetoric, even with a power hungry and callous GOP, but I was very concerned at the prospect for continued violence in the United States before and after the election. A bit naïve but I’m Canadian, so I get a pass.

Ultimately, in my forecast, I said Trump-Pence will lose to Biden-Harris in November. That was my call in January, it was correct on November 3rd, when the election was called and has been proven correct notwithstanding the many attempts to challenge it.

Looking around the rest of the world, I had expected that the Iran Crisis would continue to percolate with low energy prices, sanctions and the ravages of the pandemic. While internal unrest continues to rise in Iran and the US shows no sign of relaxing its pressure on the regime, the expected Iranian saber-rattling never materialized in as potent a fashion as I anticipated. This, more than likely, being driven by cold calculus on the part of the Iranian regime that an unhinged Trump was more than likely to nuke them for a misstep and that their best hand to play is the pair of twos they might get at the table with a Biden administration that will want Middle East peace so it can fix its domestic issues.

The much-touted “peace deal” between Israel and the UAE and other non-Iranian dictatorships in the region to me are nothing more than a papering of what was a pre-existing soft peace and mutual tolerance and not worthy of celebration. Let’s face it, the only Israeli/muslim world peace deal that will matter is with Iran and that ain’t coming.

As for the rest of the world, I know it sounds heartless, but humans, for all their nobility and charity in times of crisis, are still angry beings, given to waging war and fomenting conflict at will. A pandemic ain’t gonna stop that, and in all reality will ultimately exacerbate already volatile situations.

That’s why I held that many countries in Africa are already on the edge (Burkina Faso, Ethiopia, Sudan) and places like Libya would remain powder kegs during the year.

Aside from Iran, I suggested two major areas that had the potential to spiral out of control if left unattended.

The first was Venezuela which is in its 1324th year of economic stagnation. With intensified US sanctions and a Russian benefactor who has moved on, Venezuela is an ongoing humanitarian crisis that threatens to boil over in a pandemic induced civil war. Their oil industry has all but disappeared, the exodus continues and Maduro has used the lack of attention from the US government to consolidate his power. A failed state that is failing further, if that is even possible.

The second area I flagged is the disputed Kashmir, a traditional area of conflict between India and Pakistan that has been threatening to blow up for decades. With the entire Indian sub-continent currently on lockdown, this will stay quiet for the time being, but India’s Modi has imperial type aspirations and everyone has a nuke. As I said in January – you have been warned. Pay attention. That said, apparently the border we really should have been paying attention to is the India-China border because what says World War 3 more effectively than the two most populous countries in the world facing off.

Little did I know when I made those predictions that a long-simmering dispute between Armenia and Azerbaijan in the Nagorno-Karabakh region would boil over, threatening to drag all the major players in the region into conflict, until it strangely resolved itself.

On the energy and environment front, I suggested 2020 was going to be a year of transition and that the story wasn’t going to be Light Tight Oil. Rather it was going to be ESG (Environmental Social and Governance), a movement led by uber-boring rich white dudes like Steve Schwartzman, CEO of Blackstone (largest private equity fund in the world), former Bank of Canada/Bank of England Governor Mark Carney and other investor groups supported by earnest governments including our own federal government and much of the European Union.

For a few months, this looked downright prophetic, but then with the crash in oil prices, all such conversation took a back seat.

But this doesn’t mean by any stretch of the imagination that the climate crisis has gone away and neither has the ESG movement. Opportunists on both sides of the debate are using the pandemic to reinforce their positions.

“If you think this is bad, wait for climate change”

“Climate change is the real pandemic”

“See how much we need oil and gas?”

“If we can mobilize this much capital for a disease, why can’t we do the same for a Green New Deal?”

“The climate movement has been set back a decade by this.”

Where is the answer? Somewhere in between. Climate still matters. So does cheap and affordable energy. There is no denying the critical role that fossil fuels play in keeping our supply chains moving. There is also no denying the disruptive nature of oil price volatility to global economies. If ever there was a case to diversify the energy mix away from oil it is made by the spurious and injurious actions of an impetuous millennial leader of a dictatorship with too much control of a critical resource.

2020 brought us a veritable tsunami of integrated oil and gas majors declare their fealty to the net-zero by 2050 gods and announcing plans to wean themselves from fossil fuels or at least put enough green lipstick on their business model that people will be able to ignore their transgressions.

All kidding aside, the energy transition is back in full swing and, while it is going to take way, way, way longer than the mostly non-credible prognosticators and politicians think, it is happening.

With coal now the most expensive fossil fuel out there, look for the transition away from coal to natural gas, renewables and nuclear to accelerate. Remember – this is actually a good thing.

I suggested there is, as always, a leading role for Canada to play in all this. Canada is already a global leader in ESG influenced fossil fuel production and we are a leading exporter of next generation nuclear technology. The momentum is there.

On the oil and gas front, I suggested that with the Permian not being the main focus, we are projecting significant investment in offshore Africa, Latin America and non-Iran OPEC but not Canada. And up until the pandemic, that was exactly what was happening. But in a year where demand fell in excess of 10%, prices waited too long to rally and shut-ins were the order of the day, the global capex picture is dire, off by as much as 30% for the year.

Grade? A++ on my US forecast, C+ for the rest. Overall grade, B.

Price of oil

This was the glory call and in pandemic, how bad could I have gotten? Well, going in, I had moderated my generally bullish attitude figuring that I was always high so I should moderate, plus I had expected economic softness. So, I made a conservative call. And then the pandemic came and the price war happened and prices fell below $0 so suddenly I looked like some kind of Bitcoin promoter. Ouch.

My original year end numbers for WTI were in the $60’s but I took a COVD mulligan and applied a $20 discount. New year end forecast is $42.17 and an average for the year of $40.38. At the end of Q4 the price was $48.52 and the average price $40.01. I’ll take the win on this notwithstanding the late year rally that started ironically with the Biden win.

Grade – B.

Price of Natural Gas

Ah natural gas, even in a pandemic I can’t quit you!

My original call was based on gas consumption in the US being way up, exports of LNG growing rapidly and exports to Mexico also rising. At the time production was also rising, with associated gas from the Permian a major contributor. But even then, growth wasn’t limitless. I said the catalyst for gas is still a year or so out – LNG Canada, more export capacity out of the US, the completion of the coal to gas power conversion – this all takes a ton of time. It should be noted that gas production is rapidly declining in the United States with all the rigs are being parked and shale activity pulling back.

All that said, as a domestic market, the pandemic hasn’t been as bad for gas as it has been for oil.

My year end price for natural gas (NYMEX) was going to be $3.52 and an average price will be $2.96, up marginally from last year. I also predicted a better year for AECO than I think many Canadian producers are used to. At the end of the year the price was $2.55 and the average was $2.13. That’s a miss, but since I didn’t revise my price due to the pandemic, I still get a pass. Because I said so.

Grade – D

Production

The prediction in January was that US producers would take a breather in the Permian and that with scarce capital the pace of completions would slow and the rig count would stabilize at around the 600 level.

We projected that US production would continue to grow albeit slower.

Based on year end production numbers of 12.9 million bpd of production we projected an exit production level of 13.3 million with additions happening in the second half and some decline in the first half. Under this low growth scenario, I predicted that drilling activity would decline by 10% year over year.

As luck would have it, I was half right. The first week of April the rig count dropped by 10%. And it kept dropping, and dropping. Production declined significantly during the yearand the oil directed rig count was down a staggering 80% from the end of 2019 before stabilizing and recovering into year end.

With the decline in drilling and completions, the decline rates in LTO will continue to drag on production into 2021, but we care about this year, so…

Year end production estimates from EIA was around 11.0 million bpd. These will adjust down. My revised exit rate of production was set at 11.5 million bpd, this could be off by at least 1 million. It is ugly out there. As I wrote last week, I believe LTO peaked in March, likely to never test those heights again.

In Canada, I was pretty bearish while we waited for egress issues to be solved. I suggested that activity levels would mirror last year with brownfield in the oilsands and pockets of conventional unconventional (tight oil, deep basin, condensate, liquids rich) activity in places like the Duvernay/Montney/Viking and the Bakken but not much in between.

So no growth above replacement of natural declines. Park those rigs for better times. Even ex-demand destruction, without takeaway capacity, Canada was a challenge.

My actual revised forecast was that 2021 couldn’t come soon enough for Canada’s oilpatch. And a bit of a ray of sunshine – Canadian rig counts are actually recovering better than US ones. Go figure.

I suggested that OPEC production levels would depend on what happens with the new OPEC/NOPEC agreement at the various jump-off points through the year. The key to the agreement was the Saudi/Russia collaboration which, aside from the early year disaster that led to negative oil prices, so far the revised OPEC+++++++++++ agreement is holding. I predicted the production quotas would continue well into 2021, a position borne out by the unilateral Saudi cut this past week.

The rest of the world was expected to deliver limited growth but acceleration as the year progresses with new projects in the North Sea, investments in Africa, Latin America, etc.

While some of the above was clearly out the window with the pandemic, OPEC ++++ paled to form and the US production trend was as predicted. Canada held its own and I just read somewhere that oilsands production recently hit a record. Go figure. At any rate, with capex globally likely set back at least three years, even with all this demand destruction, in any “return to almost normal” scenario, we actually need production growth.

Grade – B

M&A Activity

I forecast that the reasonable trend in M&A from 2019 would continue into 2020 as property consolidation, non-core asset sales and private equity investment all remain robust as the industry adjusts, yet again, to a new normal. I predicted M&A activity to be broadly based – upstream, downstream, oil, gas, services and everything in between in the United States but also increasingly in the great Canadian value play.

While in the early part of the year this was clearly delayed as companies figured out where they stood or if they are even still solvent, out of chaos came opportunity and as the year progressed so did M&A activity.

As Q2 morphed into Q3 and Q4, the activity level really started to heat up on both sides of the border with a number of consolidation plays happening. The theme is definitely swapping equity to achieve scale and leverage – the big get bigger and the small get a call from their bank.

In late fall, I suggested the number of operators in the United States could drop as much as 80% as a result of consolidation and that appears to be happening.

On the services side, I was bullish on energy infrastructure and related industries. Mid and downstream oriented companies will continue to be of interest to strategic consolidators and private equity. Recent activity supports this.

The projects supporting the infrastructure space will continue notwithstanding the pandemic and price uncertainty. These are long term projects in the national interest which underscores the fact that Canada is a currency advantaged, rational valuation and stable market for consolidators.

And I’m sticking to that theme.

Grade – B

Canadian Dollar

We predicted stability for the Canadian dollar this year and, aside from a plunge due to the oil price pandemic double whammy, the Canadian dollar remained a fairly stable currency, even with the massive stimulus being thrown at the economy since, all things being relative, Canada was pretty stable before and will be after. I expected the Canadian dollar to reach perhaps as high as $0.78 by year end and at year end it was $0.79. Woot!

Grade – A- (wasn’t exact match)

Infrastructure

Finally, right? I predicted that the early to mid stage of an infrastructure supercycle in Canada would continue well into the mid-2020s. My predictions…

- Line 3 completeand operational by year end – didn’t happen but at least IT IS APPROVED! (for now)

- TransMountain Expansion well underway with multiple spreadsoperating during the year in Alberta and BC. This is happening and is a major success story.

- Coastal Gas Link continuingnotwithstanding challenges. Another win for Canada.

- Keystone XL – FID issued, but I expected it to be a victim of the US election. Kudos to Jason Kenney, the Alberta Government and TC Energy for inking a deal at the darkest hour to get this critical energy infrastructure moving forward. Which of course subsequently got delayed and, of course, is likely going to be a victim of the US election unless Trudeau can work some carbon tax negotiating magic with Grandpa Joe.

I thought we might get one more LNG FID this year but clearly we are going to have to wait.

That said, with the host of multi-billion and hundred million-dollar petrochemical plants on the books as well as wind and solar investments and a federal government intent on opening the fiscal hydrant, spending is going to happen. In Canada of all places!

Grade – B-

Stock Picks

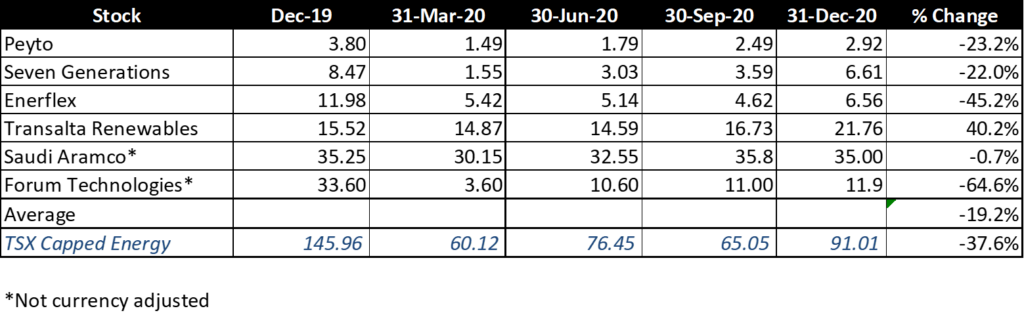

Wow. My energy stocks. Whoop dee doo. Needless to say that this portfolio does not include Tesla. With the election and trying to manage a business, I haven’t actually paid much attention to the stock market since, well, a long time ago, never mind the pooches’ parade that is my Fearless Forecast portfolio. Actually, that’s a lie. I looked at those prices October 2nd, when I updated my table. Ugh.

Anyway, true to my rules, I had to pick two Canadian E&P’s as well as two service companies and, finally, one non-Canadian producer and service company.

Let’s review these genius picks.

Pick #1 was Peyto. Gassy. Makes money in lousy markets. In theory.

Pick #2 was Seven Generations. No real logic. It’s more oily than Peyto with similar fundamentals. Merp.

On the large cap Canadian service side, I picked Enerflex mainly for its global market and relative stability.

Pick #4 was TransAlta Renewables, just to show that an oil and gas scribe can grow adapt to a new market.

I gave up on picking a US producer and instead went with Saudi Aramco, figuring that if you have to own an oil and gas stock, you may as well own the one that controls the market.

On the service side, I also went global and picked Forum Technologies. Beaten down, chewed up and spat out. What could go wrong?

Wow. Ahead of the index, but maybe I should stop picking energy stocks. Maybe it is time to invest in renewables since that’s the only pick that made money. (ducks)

Grade? Pass. Barely. C.

Well there you have it. Another year in the books. Wondering what 2021 will bring? Tune in next week.

Overall Grade – B-, it was a hard year, so I gave myself a break.