Remember last week when I said my blog was going to be unpopular? Well I was right. I did indeed receive some feedback of the opposite of positive variety. Oh well, it happens, right? I mean not everyone agrees about everything.

For those of you who don’t recall or didn’t read it because you thought it was going to be one of my damn poems again, the gist of it was as follows:

No, the Saudi dispute is not evidence that the Energy East pipeline project needs to be revised. No, it is highly unlikely that a massive pipeline travelling 4,500 kilometres across Canada to export oil to Europe, India and other destinations will ever be built. Also, the politicians who are seeking to score cheap political point by railing about this from the mountain top really need to give us all a break.

Ain’t gonna happen. Nohow, noway.

See? Pretty tame right? I’m still not sure what everyone was so mad about. Look, I appreciate that this is heresy here in the oilpatch, but there is solid precedent as to why I believe this, aside from the numbers which, when you crunch them like cereal (as Andrew Leach – the Alberta’s most hated rational economist® has), show that not only does the project not make sense in the current or past market environment, it likely never will.

But I digress. There are indeed some qualitative factors that went into my opinion, some of which I will detail in my blog in three parts starting shortly, subtitled “Three Unrelated Things”

Oilpatch/pipeline history

The following is adapted from an email I sent to a friend and represents a concise and adapted history of the energy transportation industry in Canada and forms a bit of a backdrop to the Energy East “ain’t gonna happen” thesis.

So here’s how it works.

A long time ago, oil and gas production in Canada got kick started in Ontario (1851 – Sarnia) which, of course, was a major production and population centre. As a result, refining capacity was built close to this oil source (as well as Pennsylvania oilfields) throughout Eastern Canada – ultimately settling in Sarnia, Montreal, Quebec City and, more recently, New Brunswick.

While natural gas was drilled in Medicine Hat in 1890, it was only after oil was discovered in Turner Valley in 194 that things got really crazy. At that time, oil was being produced in sufficient quantities to serve the needs of growing Western provinces and refineries were built all across Western Canada including such exciting locales as Vancouver, Edmonton, Regina, Lloydminister – you get the picture.

Because the refineries in Eastern Canada were being serviced by declining Ontario production, they needed to get their oil from somewhere so a complex web of pipelines started being built that criss-crosses the US/Canada border bringing oil up from the (mostly Eastern) US and finished product back and forth.

Fast forward a few decades and Western Oil and natural gas production was quickly outstripping its local consumption capacity so increasing amounts were targeted for export. At this time, US production was robust, so demand in the east for oil was well-served and Western oil wasn’t available in enough quantity. That said, natural gas was in increasing demand as the rust belt went through rapid industrialization. The result was a TransCanada gas pipeline from Alberta to Ontario to fill this demand. Excess oil out of Western Canada was, ironically, shipped to Vancouver on the TransMountain pipeline (built in the 1960s) and refined there or exported.

Ongoing growth in North America resulted in large refinery complexes being built in the Midwest (Chicago), the west coast (California) and the Gulf coast (Louisiana and Texas).

As the 1960’s turned into the 1970s’, American production was declining and Western Canada’s prominence started to grow. In fact, during the Arab Oil Embargo of the early 1970’s, the TransMoutain Pipeline was used to load tankers to circumnavigate the Americas and bring Eastern Canadians some much needed hydrocarbons. This marked the last time Canada was “energy independent”

In the 1990s and into the 2000s, US production, particularly in Texas started a “terminal decline”, but the refineries were still there so they started to import ever more oil from Venezuela, Mexico and the Middle East. At the same time, Western Canadian production started to grow at an increasing pace and technological advances allowed for the rapid growth of the oilsands. Oilsands crude turned out to be very similar in quality/weight to the oil coming into the gulf coast and Midwest so demand for this heavy product soared in the US, resulting in the construction of even more pipelines (Vantage, Keystone) going south into a ready and willing US market. Because of our proximity and lower quality, our oil is cheaper than others so all these heavy oil producing refineries love Canada.

Interestingly, with this whole spider web of pipelines a lot of our oil ends up in Sarnia and Montreal. It’s not unusual for a barrel of oil produced in Alberta to cross the border 5 or 6 times before it reaches its final destination.

Fast forward to the present day.

Production in Canada has grown significantly to well in excess of 4.2 million barrels of oil per day. This production, combined with offshore production in the Atlantic is enough to supply all of Canada’s needs but… we don’t have enough refining capacity to process it all and no way to get the right quantities to the right refineries anyway. Remember those refineries in NB and Quebec and Montreal? They are primarily set up to process lighter oil, not our heavy stuff.

The result is that between 3 million and 3.5 million barrels a day is sent to the US (gulf and mid-west), which actually really, really wants and needs our oil. So rather than serve our domestic interests we make money hand over fist sending oil to the single largest consumer of oil on the planet.

Ultimately though, the market is an integrated continental one with product flows, production and refining in a delicate balance.

On the pipeline front, we have outgrown our existing shipping capacity however with the TMX, Keystone XL and Line 3 expansions happening, we should be OK for another decade or so given existing growth projections. Note that these are all export pipelines.

As it regards Eastern Canada, it is hard to buy into the “buy Canadian oil” shtick. The Energy East pipeline was a bad idea conceived at a time when Keystone XL had been turned down and was a 4500 km pipeline that would repurpose the existing TransCanada gas pipeline to carry heavy oil to refineries along the way that weren’t set up to use that oil anyway. Ultimately it was an export pipeline to get oil to the New Brunswick coast. No matter what, Canada would still be importing oil.

Ironically, the massive expansion of US oil production in Texas is producing massive amounts of the type of oil our Eastern refineries are designed to process so ever larger amounts are being imported from the US. At the same time the refineries in Texas are importing increasing amounts of heavier Canadian oil.

As long as everyone calms down, the whole thing works and is a virtuous and balanced relationship that makes Canada and the US energy self-sufficient for all intents and purposes as well as super-rich countries. It’s when the energy industry gets politicized that bad decisions get made – no matter your political stripe.

That’s all I have to say on that for now.

Losing Sight of Things in the Permian

The Permian Basin is the be-all and end-all of oil production currently. Notwithstanding the previously documented transportation woes that make our pipeline issues look tame, investment in the Permian continues at a frenzied pace. Drilling activity is through the roof, DUCs are quacking, completions are rocketing forward, companies continue to make money hand over fist all the while financing their growth through cash flow – it is, in a matter of words, freaking awesome… or is it?

I wonder if maybe the emperor needs a new set of clothes because it seems to me that there are some pretty major cracks in the Permian story. Cracks that are being filled in or covered by corporate bafflegab and headline grabbing M&A such as Diamondback Energy’s Texas Two-step $10.4 billion acquisition spree where they acquired one competitor for $1.2 billion on a Monday before executing the two for Tuesday takeover of Energen for a further $9.2 billion the next. Pretty good deals, and on the surface not so over-priced on a per acre basis as the last Permian mega-merger ($88,000 vs $59,000). On a flowing BOE – more than $100,000 which is hard to stomach given 70% plus decline rates, but who am I to say? Maybe a little rich for my blood, but if you are going to play, you gotta pay.

Obscured by this is the ongoing mountain of debt that continues to pile up in the Permian ($350 billion (or is it trillion?) and counting) and the startling losses reported in Q2 – ostensibly when all these fine, super-efficient companies should be capitalizing on high prices and low break-evens. Yes, dear readers, it is indeed ironic beyond irony that while completely out of favour Canadian companies are racking up record profits, the average producer in the hottest oil and gas market ON THE PLANET is unable to generate positive free cash flow and is financing its operations with a witch’s brew of conventional and high yield debt, private equity and joint venture cash as well as the insidious sucker’s bet of public market capital.

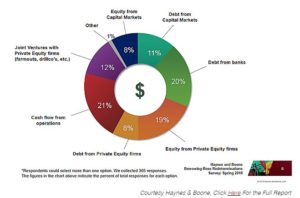

Consider the following chart:

In this chart, you can see that only 21% of operations are expected to be funded via cash flow this year, contrary to what was promised to shareholders and fully 39% is expected to come from some form of external debt with the balance via equity. Ouch. Did we learn nothing? Sorry I can’t pay for my own operations, can you spare a bill?

Add on top of this the rapidly escalating service costs (the Oil & Gas Drilling Producer Price Index is up 10% year over year), the cash flow requirements of existing debt (a massive amount of which needs to be refinanced at higher rates), the effects of poor hedging decisions, steel and aluminum tariffs, offtake issues, pricing differentials and executive compensation, it’s no wonder M&A and consolidation is starting to happen – it’s the only way to hide the bleeding and pull the wool over the market’s eyes.

Look, there’s some great players and the majors are about to take over, but… note to all you US light tight oil investors – if you want to invest in companies making money the old fashioned way – revenue less costs equalling profit – I have a few names up here in Canadaland you should consider.

Don’t believe me? The top 25 Permian producers got together in Q2 and posted, for the 1 millionth consecutive quarter, negative free cash flow, this time of about $2.1 billion, or $2.7 billion in Canadian dollars. Meanwhile, in the same quarter, Canadian Natural Resources (one company) recorded a comparable funds from operation less net capex of about $1.8 billion. All this with net production of about 1 million BOEpd. Even Peyto made money. And it’s a gas producer. And gas in Alberta is free.

Regardless. that’s a lot of money, so PSA – can we please stop defecating on Canada?

TransMountain Update and other Pipeline Foibles

Pipelines were back in the news the last few weeks and as usual, it isn’t for the best reasons.

First up was a filing made by Kinder Morgan to the SEC as part of the TransMountain transaction documentation that was designed to show shareholders whether they were getting a fair deal from the red-devil Canadian government.

Part of this filing included a scenario analysis that projected whether the pipeline expansion would still make money on a cost-inflated and further delay scenario, among others.

Never ones to shy away from shouting from the rooftops without being properly informed, the media and critics of the pipeline, the deal, the government and SEC filings in general immediately seized on the scenario suggesting a close to $2 billion increase in costs as proof – PROOF DAMMIT! – that the Liberal government was incompetent, had taken leave of its senses, lost complete control of the project and was solely responsible for global warming.

While the leap of faith required to take a projection and claim reality is fairly broad – remember that this was a scenario analysis, not a revised cost estimate or schedule – we need to be clear about a couple of things.

As mentioned here previously, the projected cost and schedule for the TransMountain Expansion is several years old. The only thing we know for sure about it is that it is going to be wrong. How wrong and in which direction is anyones’ guess, but in any project of this nature you can rest assured that costs do not go down.

Pipeline projects can be impacted by any number of project related and extraneous events ranging from higher interest costs, stupid steel tariffs, forest fires, running into rock where it wasn’t expected, higher fuel/labour/equipment costs – you name it. The $7.4 billion that Kinder Morgan was floating? It’s going to be higher. My guess is an even $10 billion. And I’m not fussed by it. Get it built. There. See how easy that was?

Late-breaking news on Thursday on one of our favourite projects, the Keystone XL, saw a Montana federal judge rule that the new Nebraska routing had to go through a formal State Department environmental review because the one done in 2014 was for a different route. This is, of course, a bit of a setback for the timing of the project. But it ain’t gonna stop it. Let’s parse the ruling for a minute. First, the judge didn’t pull the permit – which is what the environmental plaintiffs wanted. Second, the state department had done a preliminary study which found in favour of the project, the judge is asking for a more rigorous analysis – so worst case they do that. Third – TransCanada hasn’t indicated that this is affecting their timing in any way yet, so we need to stop projecting.

Last point on this – it is interesting to note that the ruling came in Montana, about a project routing in Nebraska – why, you may ask yourself, is a federal judge three states removed from the location of the complaint presiding over, let alone ruling on this? Politics much? Not 100% sure who nominated this particular judge but it occurs to me that a Trump nominated judge might have had a slightly differing view. Stay tuned for the appeal to a higher court.

Lastly, I saw that a bunch of pipeline projects in the US have been stymied over environmental concerns. Good. Why should we have all the fun.

That’s all I’ve got – have a great weekend.

Prices as at August 17th, 2018 (Aug 10, 2018)

- The price of oil fell during the week on trade worries and a big rise in inventories

- Storage posted a big increase

- Production was flat

- The rig count in the US was down

- After a smaller than expected injection, natural gas gave up some ground then rallied thru the end of the week…

- WTI Crude: $65.91 ($67.63)

- Nymex Gas: $2.946 ($2.944)

- US/Canadian Dollar: $0.76635 ($ 0.76220)

Highlights

- As at Aug 10, 2018, US crude oil supplies were at 414.2 million barrels, a increase of 4.8 million barrels from the previous week and 59.1 million barrels below last year.

- The number of days oil supply in storage was 23.6 behind last year’s 26.7.

- Production increased for the week at 10.900 million barrels per day. Production last year at the same time was 9.502 million barrels per day. The increased production this week came from increased production in Alaska and constant production in the Lower 48.

- Imports rose from 7.931 million barrels a day to 9.014 compared to 8.126 million barrels per day last year.

- Exports from the US fell to 1.592 million barrels a day from 1.850 last week and 0.877 a year ago

- Canadian exports to the US were 3.456 million barrels a day, up from 3.432.

- Refinery inputs were up during the week at 17.981 million barrels a day

- As at August 10, 2018, US natural gas in storage was 2.387 billion cubic feet (Bcf), which is 20% lower than the 5-year average and about 22% less than last year’s level, following an implied net injection of 33 Bcf during the report week

- Overall U.S. natural gas consumption was down 3% during the report week

- Production for the week was up 0.5%. Imports from Canada were down 5% from the week before. Exports to Mexico were up 4% from the week before.

- LNG exports totalled 24.5 Bcf.

- As of August 17th the Canadian rig count was 212. Rig count for the same period last year was actually higher.

- US Onshore Oil rig count at August 17, 2018 was at 869, constant from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was cosntant at 186.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was up 1 at 21.

- Offshore rig count at January 1, 2015 was 55

US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 62%/38%

Drillbits

- Ensign Energy Services made a bit for Trinidad Drilling which is a big deal. If anyone could find evidence it actually happened.

- Trump Watch: More weirdness from the Don. Maligning Canada, revoked security clearances… Omarosa…