An abbreviated blog this week as we at Stormont celebrate American Thanksgiving by sending an endless amount of emails to all our American contacts asking them inane question because we know they are on holiday and it bugs us. Particularly since Canadian Thanksgiving was 6 weeks ago.

Speaking of Thanksgiving, I would like to give thanks for the eminent wisdom of government, in particular the provincial government as they struggle with the issue of landlocked Alberta resources and try to find solutions for how to get Alberta oil out to the masses of buyers clamouring to get their cokers and upgraders filled to the brim with some good old Alberta sludge. The province is so committed to this process that they have, all on their own, decided to assemble a team of envoys to travel the land, far and wide, and consult with the elite, the intelligentsia, the corporate robber barons, the greedy integrateds, the well-heeled and well-compensated executives who are currently under-populating the gleaming glass towers of downtown Calgary. The goal of this consultation of course is to brainstorm and come up some otherwise unknown or unthought of strategies to save us from ourselves. Not quite the three wise men bringing gifts to the baby Jesus or the three witches from MacBeth giving prophecy, but a thoroughly well-trodden governmental tool to show that they do in fact “care”.

So, a whole three to four week process, likely costing a bit of dough we don’t have to come up with some solutions to a problem whose resolution is pretty obvious. Okay then.

The whole thing of course got me thinking – an always dangerous thing. As these esteemed individuals come to Calgary in search of wisdom, surely I could consider myself consultable, as a titan of industry no less? No? Maybe? Not even. In fact, I looked in the mailbox (both physical and virtual) and wouldn’t you know it, not a single letter of invitation or overture from the envoy group. This of course made me a bit mad so I decided to do the only thing I really could and for which the fair citizens of Alberta will no doubt be eternally thankful.

Namely, in order to save both time and money and to save Alberta from itself, I put together my top 10 super-crunchy ideas for solving the differential and market access issue. Someone tell those envoys to stay home. I’m on it.

First, a quick review. What is the differential and market access issue? It’s that situation we are in where our product is massively under-priced relative to global benchmarks because we can’t get it to where it’s wanted because there aren’t enough pipelines and we only have one customer and let’s face it, they don’t really care about the price of our oil.

Got it? Okay, the top 10.

Get a new customer

Obvious right? Seriously people this is going to be a piece of cake. How come no one has thought of this before. If we have a new customer, then that means that we have more demand for our products. That means that we can charge more. Bam. Supply, demand. Someone call China. But wait a second. That’s all well and good, but they can’t use the oil here can they. They will probably want to use it in China. So we have to figure out how to get it to them. I guess that is what they mean by market access. Maybe this won’t be as easy as I thought. But it was a good idea, right? You know what would really make this idea stand out? A pipeline. We should really just build one of those.

Invent a Star Trek Transporter or one of those wormhole thingies

This is a truly inspired idea I think. Those transporters were super cool on the show and I bet that if we invent one, we could rig it so that it could deliver oil from one spot to another on a continuous flow to address the volume issue. Alternatively, the wormhole seems to be a fairly continuous passage which would work as well. So it really becomes an issue of securing the locations where demand for Alberta oil is the highest and transporting it there. Once established we could put the best and brightest minds at work to figure out how to scramble and rescramble the molecules such that what comes out at the end of the transport process is some form of refined product. This of course will save us all tons of money from having to build refining and upgrading capacity at home. And of course will make pipelines obsolete which should be a hit with the environmental movement. Taken to its extreme, this type of technology I suppose makes transportation fuel obsolete which will crush the oil industry, but I hear there is a hefty deposit of dilithium crystals up north around Boyle, Alberta.

Rebrand Western Canada Select as WCS IPA

Who doesn’t love a cold, crisp, hoppy IPA? I bet if we renamed it would be way more popular. Plus, as a craft beer, you can charge more which solves the differential problem quite handily I think. As for market access, everyone knows beer can travel the world in a variety of ways – can, bottle, keg – the options are quite limitless. Add in the fact that Canadians are beer-swilling kooks we could probably increase domestic consumption at the same time. While our interprovincial trade barriers might make it more difficult to move across the country I’m sure this is something the federal government could fix. Right? As for crossing into the United States, that happens with beer all the time, plus there are all those remote bootlegging routes that Canadians used during Prohibition. Of course, now that I think about it a little more, 4 million barrels a day would fill up a lot of beer cans that would then have to be trucked, which is really expensive. What we really need then is a beer pipeline.

Dig a canal

We’re already busy trying to figure out flood mitigation here in Calgary so why not take it a step further. We could dig a canal to get our oil to places where it’s needed. It worked for Egypt, I see no reason why it can’t work for us. In fact, why stop at one? Let’s dig three canals. Three giant, deep canals that are large enough to allow mid-sized tankers to pass back and forth. The first one is obvious. It could start near Edmonton and run East all the way to Thunder Bay. Once in Thunder Bay the tankers could continue East through the Great Lakes to the Saint Lawrence River, hitting Montreal and Quebec City along the way before dropping off the rest of their cargo at the Irving refinery in Saint John. Heck, if they still had oil left the tankers could continue on to India! The second canal would start in the same place but head southeast, cross the US border and then cut across the Dakotas, into Nebraska and finally into Cushing Oklahoma where the oil could be put into storage or pumped into the US leg of the Keystone XL project, which has been moving oil to the Gulf Coast for almost five years now. The last canal is of course the most challenging, but this one would start outside of Edmonton, cross the Rockies into British Columbia and take a hard turn south and west before connecting with the Fraser River into Vancouver and then out to sea. The best part of this is that the tankers would avoid the Great Bear Rainforest and not be subject to any coastal tanker bans. Any one of these canals could be considered a nation-building project in its own right. Doing all three is downright genius. I know a pipeline would be easier, but as a country we need to aspire to great things.

Even More Crude By Rail

Look, I know that crude by rail is expanding as rapidly as the private market and the rail companies can do it but every time you talk about increasing rail shipments of oil you get all bogged down in comments like “what about the farmers” and “it’s too expensive” and “there’s not enough capacity”. To all of these comments, I say balderdash. Crude by rail has always had a critical role to play and much like the canals proposed above, in Canada at least the great railways have always had a special cachet. So why not build a new one! I think this is something that TransCanada should seriously consider. Look, they have all this right of way they’ve committed to for Keystone XL, who’s to say they couldn’t just slap down a thousand kilometres or so of track and then, when the time is right, start running miles long trains up and down the track bringing wonderfully sticky bitumen to the masses. I bet the approval process for new train track is nowhere near as baffling or subject to political interference as pipelines. The best part is that once the track is built, it seems no one really cares what you ship on it, as long as you don’t have to sit at a level crossing for too long.

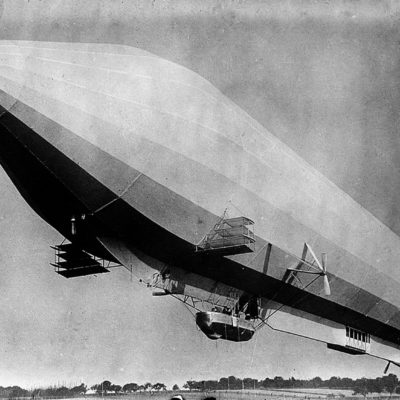

Oil by Blimp

This one is a bit out there, but we could manufacture the world’s largest fleet of transport blimps and stage them directly out of Fort McMurray. Bitumen could be loaded into specially designed, lightweight containers, attached to the blimps and then released into the sky. With the prevailing winds and jet-stream, the oil blimps could travel along a route that would be very close to the now defunct Energy East pipeline. Personally, I think the best part of the blimp idea is that it uses renewable energy (wind) to deliver a fossil fuel product so it actually results in a lower carbon footprint for Alberta oil. I understand that there may be some safety concerns about massive amounts of oil floating overhead of large population centres, but last time I checked, there had never been a major blimp disaster. Final point – if Phileas Fogg can go around the world in 80 days, surely our oil can make it to China in less time using the same tech.

Refine and upgrade more here at home

This is a popular one. Many people think it is high time that we processed more of our energy products here at home rather than ship it out as raw material to other countries to be processed there. From partial upgrading of bitumen to allow it to flow in pipelines without diluent to full refining to incentivizing the emergence of an entire petrochemical industry, this is the holy grail of any major fossil fuel producing jurisdiction. Of course Alberta is already home to plenty of upgrading and refining capacity and is also home to one of the largest polyethylene plants in the world in Joffre. And with prices for feedstock so depressed with the differential it makes eminent sense to see this develop even more, but there are already projects underway and finally, what do you do with all the product? The end market isn’t Alberta. You have to ship it to where it is in demand? Thinking some of that may require a pipeline or a lot of non-existent rail capacity.

Cutbacks in production

This is of course the ONLY available short term solution. And it can probably help in the short term to soak up the inventory build that has occurred since the summer. But in a free market, it is hard to make that work. Who cuts what and how much? We have already seen voluntary shut-ins of close to 150,000 barrels per day. That’s a lot but what happens is one man’s cut is another’s growth. Voluntary cuts in a free market generally don’t last because everyone is trying to make money. And there is no OPEC level organization in Alberta to coordinate these cuts and apply the required discipline and the largest producer – call it Alberta’s Saudi – is Suncor. And Suncor has been making record profits off the high differential because they have refining capacity. On the flip side, many are calling on the government to institute cuts. We covered that last week and why it was such a bad idea. But to reiterate – it’s a bad idea. Why in the world would you ever ask for precedent setting government control over the production of a resource that is the subject of so much controversy. Bad idea. Not to mention, it’s clearly temporary. You still need a pipeline. Or a blimp. Or a canal. Or crude by rail.

Reinstate the income trust for oil and gas producers

Look. It has nothing to do with pipelines and really I’m just checking to see if anyone is still reading. That said, if you want to revive the junior and intermediate market, which we really should be doing as that is where most of the employment is, you need to make financing easier. Do it just for oil and gas. No cockamamie service roll-ups of businesses that don’t belong together, no “cannabis income funds”, just oil and gas. It worked before, it’ll work again. Trust me.

Build. A. Pipeline

Simple right? Was there ever any doubt? Build it. We need it. The country needs it. Wow, that was easy wasn’t it? Hate to spoil the party, but this is the only solution that will work.

So what was the purpose of the list? It’s pretty obvious isn’t it? All of these absurd, borderline lunatic ideas will never work, will cost way too much money and won’t solve the root problem. WHich is a lack of pipelines.

We have a thriving energy industry that is hamstrung by regulatory uncertainty, a lack of market access and a resulting pricing differential that is siphoning money out of government coffers. As a result, critical investment in the sector is going missing. People are losing their jobs and tax payers are getting short changed.

The answer is clear.

Build a pipeline.

Build. A. Farging. Pipeline.

OK????

#buildapipeline

sheesh.

Prices as at November 23, 2018, (November 16, 2018)

- The price of oil fell precipitously during the week on a combination of supply build, Iran, Trump tweets and stock market jitters. OPEC needs to act or risks undoing an entire year worth of effort to stabilize prices and reduce stocks. Low prices now could lead to a forward oil price shock of epic proportion.

- Storage posted another increase

- Production was flat

- The rig count in the US was down

- No natural gas report this week but prices held steady…

- WTI Crude: $50.39 ($56.77)

- Western Canada Select*: $14.64 ($20.48)

- AECO Spot *: $1.92 ($2.55)

- NYMEX Gas: $4.309 ($4.359)

- US/Canadian Dollar: $0.7568 ($0.7606)

*Due to overwhelming interest, we are now including prices for Canadian commodities, in case you weren’t angry enough.

Highlights

- As at November 16, 2018, US crude oil supplies were at 446.9 million barrels, an increase of 4.9 million barrels from the previous week and 10.2 million barrels below last year.

- The number of days oil supply in storage is 27.8 compared to 27.0 last year at this time.

- Production was flat for the week at 11.700 million barrels per day. Production last year at the same time was 9.658 million barrels per day.

- Imports rose from 7.432 million barrels to 7.554 million barrels per day compared to 7.873 million barrels per day last year.

- Exports from the US fell from 2.050 million barrels per day to 1.969 million barrels per day last week compared to 1.591 million barrels per day a year ago

- Canadian exports to the US were 3.296 million barrels a day, down from 3.507

- Refinery inputs rose during the during the week at 16.855 million barrels per day

- With Thanksgiving there was no release of data for the week ending November 16.

- As of November 23, 2018, the Canadian rig count was 204 (AB – 138; BC – 17; SK – 43; MB – 4; Other – 2. Rig count for the same period last year was 148.

- US Onshore Oil rig count at November 23, 2018 was at 885, down 3 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States were flat at 194.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was up 1 at 22

- Offshore peak rig count at January 1, 2015 was 55

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 65%/35%

Drillbits

- Trudeau came to Calgary. No one really cared.

- Cimarex announced that it has entered into a definitive agreement to acquire Resolute in a cash and stock transaction valued at $35.00 per share, or a total purchase price of approximately $1.6 billion

- No Canadian companies did any M&A

- Trump Watch: A couple of turkeys were pardoned. And no, they weren’t part of… Trump did his best to tweet the US energy industry into a downturn and played some harsh realpolitik by acknowledging it really wasn’t in the US’s strategic interests to rock the boat on Saudi Arabia killing its own journalists.