I believe that I owe my loyal readership a massive apology. It all starts with last week’s Sweet 16 energy bracket and the fact that I was in such a tizzy about the opening round basketball games that I didn’t give anywhere near enough thought on what I was writing and picking and I sure paid the price. Well at least my NCAA bracket did. I hope no one took any of my picks all that seriously.

I mean seriously, my NCAA picks were an abomination. UVA? I love the University of Virginia, I love Charlottesville. I’ve visited there. The CFA mothership is located there. I’ve been to vineyards nearby (not Trump’s). Heck, I’ve even walked on the Appalachian Trail nearby. But it’s safe to say that I have never picked the University of Virginia in a basketball pool. And I never will again.

But why did I pick them? I picked them because the polls told me to. I picked them because it seemed like the right and easy thing to do – I didn’t take the time to do the work, see the subtleties. Realize that of the top teams in the tournament, not one was without blemish and each had lost to remarkably weaker opponents. If I had bothered to slow down, I might have seen that the upset-fest that unfolded over the weekend was almost inevitable.

The same can be said for the energy bracket. I regularly put a lot of work into the weekly missive, but I feel that this past week I did a bit of a disservice, In other words, much like my NCAA picks, I kind of rushed it, without maybe the process and rationalization that I typically do. I mean seriously, who introduces an ominous and all-powerful Black Swan into the energy conversation, pegs it as the dominant force for the year and then checks out for the weekend?

…

Well yeah. Me. But that’s beside the point.

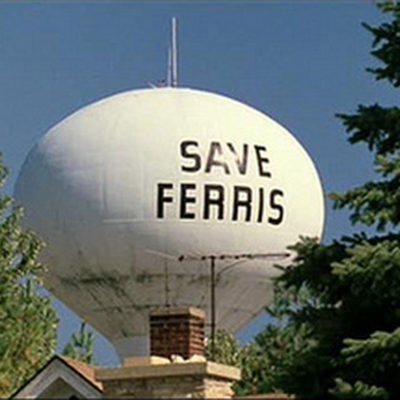

I guess what I am trying to say is, in the immortal words of Ferris Bueller:

“Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.”

So, in the interests of slowing down, and out of respect for Spring Break which is fast approaching (as in, I’m already on Spring Break), the following are a few things that I personally would like to slow down a bit on or take a closer look at…

First off, the NCAA Revised Final Four. Clearly Virginia is out and my colossally bad pick was karma for me not picking Duke like I always do. So, Duke wins. There, all is now right with the Cosmos. Other teams? Don’t care.

The Black Swan

The concept of the Black Swan is nothing new. I’ve written about it before, you’ve read about it before. But why did I bring it up last week? A “black swan event” is typically an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. So where did it come from? The voice in the back of my head. Which is telling me things…

In the oil and gas sector, there are many such instances where some global event caused a spike or collapse in energy prices that fit this description. Events like the Arab Spring, the collapse of Libya, any of the Arab-Israeli wars, the invasion of Kuwait, the collapse of Long Term Capital Management, the implosion of the Tech Bubble, the 2008 Financial Crisis. All of these are events that caused major disruption in global economies and brought about major moves in commodity and asset values. And all were followed by a lot of “totally saw that coming” moments from analysts, pundits and the like that in fact had, for the majority, not a flippin’ clue that they were about to smacked upside the head by events out of their control.

Another point to consider is that these events do not happen in isolation. They have precursors, triggers and catalysts. One thing happens that leads to another that leads to another. Typically they are outside industry events that need a boost to get over the fence. And they often happen at the times where optimism appears to be at its highest and the people who should pay attention aren’t. Hence the need to slow down and take a look around.

I know everyone is hyping “tensions in the Middle East” (yawn) as the potential Black Swan event, but for me the ultimate Black Swan is actually Donald Trump and the chaos surrounding his presidency. He is the prototypical unassociated, unpredictable actor/event that is going to take everyone’s cozy predictions and rip them to shreds. And remember, the longer we go without such an event, the stronger the warning signs should be that the next one is going to be a doozy (official Back Swan term). Consider the following:

- Massive tax cuts into an economy already at full employment (inflation)

- Significant increases in spending in the federal budget (inflation)

- Increases to health care costs (inflation)

- Maybe a wall (eye roll)

- Tariff barriers and a possible and mostly unnecessary trade war (this is the most dangerous and, inflation)

- Staffing turmoil and an increasingly hawkish foreign policy team

Layer on top of that the uncertainty of the outcome of the Russia investigation, mid-term elections, Stormy Daniels and the other ladies and you have a recipe for chaos and upheaval of epic proportion.

Even at its most basic, all these inflationary policies have an effect. After all, what do we do to address inflation and cool things down? Right. We raise interest rates.

Inn many analysts’ eyes, almost all of these initiatives are unduly inflationary at exactly the wrong time in the economic cycle and will impact the oil patch and the price of oil whether through increased costs at the field level or rising interest rates that threaten to tip over massively indebted shale players.

If you ask me, the Black Swan event is unfolding all around us right now and has the potential to overwhelm the energy sector.

TransMountain Expansion

Okay, on a more positive note, can we all agree to slow down on the TransMountain expansion?

I don’t mean slow down THE expansion, I mean slow down on the breathless commentary about it.

Admit it, it’s exhausting. And I’m as guilty of it as the next guy.

Why aren’t they building that pipeline yet! Shut off the taps! Stop buying wine! Tax out of province homeowners! Protest! Lawsuit! Spills! Catastrophe! Keep it in the ground! Shut off even more taps! Foreign influence! Notley! Carbon Tax! Big oil! Koch Brothers! Canada’s climate plan!

And that was all just on Tuesday!

But it doesn’t have to be.

Life may come at you fast, but you know what doesn’t? Especially in Canada? That’s right. Pipelines.

I had this conversation with someone the other day. No matter how much noise is being made about the TransMountain expansion, it’s going to go at the pace it’s going to go at.

This is a 1200 km pipeline across some of the most rugged mountain terrain in North America. It was never going to happen overnight. It seems to me that in all this mess the only party that is acting sane and keeping its head above the hype is the project proponent – Kinder Morgan. Why is that? Could it be that they are more secure in their view that they are going to build a pipeline?

And they aren’t going to cut and run at the first sign of trouble or the 61st. Kinder Morgan bought the company that owned the pipeline in 2005. Then they sold off all the assets except the TransMountain pipeline. Why? Because it’s the rainbow and the expansion is the pot of gold. It seems to me that Kinder Morgan has known what it was doing and wanted to do all along.

But what about all the protestors? What about them? It’s a free country.

What about the Federal government? What about them?

Well, take a step back and look around. What has gone largely unnoticed is that in the last six months virtually every decision by the NEB (i.e. the arm’s length judicial body that is part of the federal government that has exclusive jurisdiction over the TransMountain expansion) has been in favour of KinderMorgan and the pipeline expansion. Why? Because it was federally approved and the proponent was deemed within their rights. Again, what about the protestors? Well there’s an injunction and if they break it, they get arrested. Which they have. If they choose to be violent against the police, I suppose that is within their prerogative. But it only looks bad on them. Kinder Morgan hasn’t taken a bad step in months. The only parties that look bad are the protestors.

As it regards the governing Liberals and Justin Trudeau, I am on the record as saying they need to step up and defend their decision. And lo and behold, they kind of are. It may have been amusing and annoying to see Trudeau saying dumb things on stage with Bill Nye the not so science guy, but when challenged on TransMountain he shut him down. Similarly he gave that interview to the National Observer – a progressive, anti-fossil fuel publication where he again defended the pipeline and the decision to build it. The choice of publication wasn’t accidental – it’s the audience he wanted to reach – the protestors aren’t reading the National Post. Heck, we even have Environment Minister Catherine McKenna coming out and saying the pipeline has to be built.

Look, I know it’s not the charge of the light brigade, but it’s the way this government works. Touchy-feely, coercion, sunny ways.

Take a step back. The parties that actually have the ability to influence the construction are actually doing what needs to be done.

It’s a horrible way to make a sausage, but it’s what we have. It will get built.

If you really have a pipeline beef, take it up with TransCanada. The time to announce a final investment decision on Keystone XL is long past. They have the Trump approval. He isn’t going to last forever, some people think he won’t last the year. What. Are. You. Waiting. For?

Permania and massively growing US production

OK, this is the last one. Look, I get where these numbers are scary for Canadian producers. US production is at a record high and is going to go higher before it can rationalize. Can the oil price handle it? Probably not of it continues unchecked. Certainly not if all oil was the same. Wait, what?

Ah, sameness of oil it’s not , says Yoda. That’s right, unlike electricity, oil is not a “fungible” commodity. What does that mean? Well in electricity one electron is the same as another and it doesn’t matter if it was produced by wind, solar, gas, coal, oil, nuclear or flared cow farts – once it’s in the wires it’s the same.

Oil on the other hand has as many different grades as you can shake a stick at. That’s why we have all these discussions about Canadian heavy oil and Western Canada Select and West Texas Intermediate and Arab Heavy and Bonny Light and Venezuelan Heavy and Light Tight Oil. And why everything has different prices.

Oil quality is differentiated using the API scale of “gravity” with, for example 8 being very heavy (think Bitumen), 30 being average and anything over forty considered light or condensate.

I follow a bunch of guys on Twitter (yes I follow Trump as well) who are doing a lot of research into crude quality and what impact it has had on refining, storage, US exports, imports and the implications for the future. And they are all way smarter than me, so I might mess it up a bit.

The starting point for this exercize is that the big concern with all this incremental US production is that it is going to displace all the oil produced around the world and make the US the swing producer and lead to price Armageddon yet again. What these analysts are arguing is that the LTO guys are indeed a swing producer, but only on the light side of the market.

What? OK, slow down and bear with me.

First off – virtually all the growth in production in the US is coming out of the Permian and other light tight oil producing regions. Interestingly, the API rating for much of this product is 40 degrees and higher which makes it very light and not suited for a lot of the refinery runs in the US which are mostly set up to process heavier oil. So what to do with all this growing supply? Well you can blend it with heavier oil and refine it, in which case you need more heavy oil or, you export it.

First, let’s look at refining. The obvious question is why not reconfigure refineries to process the LTO? Maybe, but with heavy oil you can crack the molecules and make different products. With the light oil – not so much. Lighter oil is ideally suited to make gasoline but gasoline demand is expected to fall, so refiners want to make distillates where demand is growing and for that they need… heavier oil. And blending only takes you so far. Why would you invest billions to reconfigure a refinery to make a product that is already well supplied when you can make way better margins upgrading low priced heavy oil?

OK, back to export. Where do you send it? Well you send it to the refineries that will take it. Problem is that the rest of the world isn’t set up for light oil either, at least not in the growing volumes being produced out of the US. It turns out that the market for light tight oil isn’t actually the “global market for crude” but rather a smaller subset of that.

So instead of exporting it, you have to store it. But storage is full. So then you have to export the oil that is already in storage (typically conventional, intermediate crude) and replace it with the higher gravity light tight oil that no one wants any more of. Then what? Well over and above existing demand, you need to blend it to refine it, mostly with imported heavy oil, like from the oilsands or Venezuela.

Fascinating, isn’t it? Crude quality actually matters. We have all this production growth with not a lot of places to go. As a result there is lots of light inventory that maybe isn’t so much in demand. Big demand for heavy oil, which appears increasingly supply constrained from places like Mexico and Venezuela. All in a global market where overall demand is growing at its fastest rate in years. Oh, and a couple of Canadian pipelines slowly inching forward to deliver the heavier oil that it seems refiners actually want. Go figure.

Life comes at you fast. If you don’t stop and look around once in a while, you could miss it.

Prices as at March 23, 2018 (March 16, 2018)

- The price of oil rose rallied during the week on a fairly bullish storage report.

- Storage posted a large draw

- Production was up marginally

- The rig count in the US was mixed

- After a larger than expected withdrawal, natural gas recovered a bit from a steep fall…

- WTI Crude: $65.91 ($62.22)

- Nymex Gas: $2.587 ($2.694)

- US/Canadian Dollar: $0.7786 ($ 0.7636) – just in time for Spring Break, thanks a lot Bank of Canada!

Highlights

- As at March 16, 2018, US crude oil supplies were at 428.3 million barrels, an increase of 2.6 million barrels from the previous week and 104.8 million barrels below last year.

- The number of days oil supply in storage was 26.4 behind last year’s 34.2.

- Production was up for the week by 26,000 barrels a day at 10.407 million barrels per day. Production last year at the same time was 9.129 million barrels per day. The change in production this week came from a increase in Alaska deliveries and a slight increase in Lower 48 production.

- Imports fell from 7.585 million barrels a day to 7.077 compared to 8.307 million barrels per day last year.

- Exports from the US rose to 1.573 million barrels a day from 1.485 last week and 0.550 a year ago

- Canadian exports to the US were 3.423 million barrels a day, up from 3.098

- Refinery inputs were up during the week at 16.777 million barrels a day

- As at March 16 2018, US natural gas in storage was 1.446 billion cubic feet (Bcf), which is 19% lower than the 5-year average and about 32% less than last year’s level, following an implied net withdrawal of 86 Bcf during the report week

- Overall U.S. natural gas consumption was down 5% during the report week, influenced by weather

- Production for the week was flat. Imports from Canada were down 2% compared to the week before. Exports to Mexico were flat.

- LNG exports totalled 14.9 Bcf.

- As of March 19 the Canadian rig count was 221 – 162 Alberta, 11 BC, 44 Saskatchewan, 3 Manitoba and 1 elsewhere. Rig count for the same period last year was about 270. Warm weather may have impacted activity levels. Spring breakup approaches or has begun in many areas

- US Onshore Oil rig count at March 23, 2018 was at 804, up 4 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was up 1 at 190.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was flat at 13

- Offshore rig count at January 1, 2015 was 55

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 70%/30%

Drillbits

- The BC government announced a set of tax incentives that it will provide to LNG Canada if the $40 billion Shell led project elects to proceed with a FID. Green party leader and coalition puppet master Andrew Weaver is not amused

- A group of First Nations who support an energy export corridor to Prince Rupert have officially filed a lawsuit against the Federal Government over its tanker ban off the coast of British Columbia

- The US held the largest ever offshore oil lease auction it has ever held and drew very tepid response

- Alberta released its latest provincial budget. Wow. That’s a lot of debt.

- Trump Watch: HR McMaster out, Bolton in. $50 billion in China directed tariffs. Retaliation being prepared. Down off close to 1000 points. Another porn star lawsuit. Judge says a civil suit for harassment can proceed. Lawyer quits.