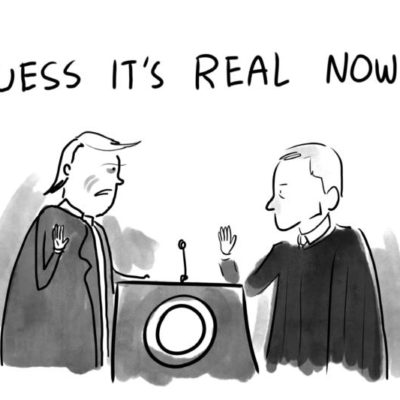

Well, there you go. It’s done. I have to say, the inauguration has always struck me as one of the more uneventful events in the political theatre, everyone is on their best behaviour, it’s civilized and quite often it’s cold and rainy so it seems like everyone just wants to get on with it and go to a party.

That said, Day 1 of at least four years of America First and I suspect no one is really ready for, or has any idea what the ride is actually going to be like. What we do know is that the approach to politics and governing could not be any different between the incoming and the outgoing leaders of the free world.

I’m not particularly up for a long dissertation on the impact of the new Trump administration, particularly as right now it is mostly conjecture. There are things that will happen that I disagree with, that I’m neutral on and that I may actually favour, but at the end of the day, it’s not my country, I don’t have a vote so I don’t have a say. So I think it’s time to step back and let the world unfold as it will, particularly for the next 100 days which is typically when a lot of the new agenda gets implemented. Expect a flurry of executive orders, rescinding of executive orders, confirmations, legislative fisticuffs and tweets galore. As major policy gets introduced that has an impact on Canada and the oil patch, we will discuss it on the run, but right now, I have to apologize.

That’s right, I need to apologize for my spectacular forecast failure.

I let my heart rule my head and predicted a Kansas City-Green Bay Super Bowl over the Green Bay-New England one my brain was telling me. I don’t know what was in my cup of tea while I was writing that, but rest assured – no more whiskey before lunch! So, that is my forecast mulligan and I intend to use it. Why in the world I thought Andy Reid could game plan a win against Pittsburgh is an unanswerable question. So, for the record, my brain now says GB-NE in the Super Bowl with a New England win. That said, wouldn’t it be cool if it was Atlanta vs Pittsburgh and no one tuned in?

Anyway, a couple of items of note during the week:

First, Kevin O’Leary, TV personality and professional self-promoter and erstwhile business genius, best known for stints on Dragon’s Den in Canada and Shark Tank in the US has finally, after much milking of the process, announced his candidacy for the leadership of the Conservative Party of Canada – now Canada’s official opposition. While I have no doubt that his run is going to be entertaining, I have to question his so-called “marketing genius” in announcing his run the same week as Trump assumes the presidency, but then maybe he didn’t want too, too much attention given how polarizing some of his views are.

Second… OK, fine, I admit it. This one is policy-related, and it could be long. But I couldn’t resist because there is a question Canadians need to ask themselves as Trump takes office.

What in the world is a Destination Based Cash Flow Tax and why should I care about it?

Seriously.

Well basically this bit of protectionist, trade-crushing genius of an economy killer is the Republican party’s proposed way of stimulating domestic jobs while running roughshod over 100 plus years of global trade and economic structure. This is a broad-based reform to the US tax code designed to “pay” for the Trump corporate tax cuts that would see US domiciled companies lose the ability to deduct the cost of imports for tax purposes while not being required to recognize export revenue. It’s pretty nifty, as in one fell swoop, this plan creates both a tariff and a subsidy across the entire economy which, when combined with the proposed US corporate tax cuts will result in a roughly 20% advantage/incentive for US-based companies that produce and source domestically.

So why should Canada care about this? Well considering that 70% of our exports of goods and services are destined for the United States (including basically 100% of our energy exports), we should actually be freaking out. While much of the handwringing about the new Trump administration’s trade policies has been about NAFTA and potential changes there, this fundamental change in how the United States fiscal regime works seems to have snuck in under the radar for pretty much everyone and is akin to the proverbial ticking time bomb.

So how would it work in practice? As far as I can tell, imagine that you are a widget maker in Des Moines and you have been sourcing widget parts in Canada for $4, have domestic costs of $4 and sell the finished product for $10 domestically and your closest competitor is selling the same product for $11 and sources everything domestically for $9. Under the old system, you each had a $2 profit and paid tax on that. Under the new system, you will be taxed on $6 profit (even though it is really only $2) while your competitor is still only taxed on $2. Assuming a tax rate of 20%, your competitor now has a $0.80 advantage on every widget sold so the only logical moves are to raise your price, source your parts domestically or demand concessions from your Canadian part supplier. Notionally, economy wide, this should result in more production being done domestically and a stronger currency. Practically, you’ve just pantsed all your trading partners.

Never mind that this proposal upends the tenets of global trade set over the past 100 years and the fact that it is probably in violation of World Trade Organization rules. Knowing human nature, it does not take an advanced degree in economics to follow the fallout of this to its logical conclusion. As tariffs and subsidies get implemented, trading partners follow suit and introduce their own measures, the prices of goods and services rise globally, inflation and protectionism rises and the global market system falters and leads to stagnation, recession, a realignment of the global order and if you are a student of history circa 1930 – 1939 – some pretty serious armed conflicts (Senator Reed Smoot and Representative Willis C. Hawley, long time no chat!)

So, no one really wins, everyone loses. What a great idea! Why didn’t I think of it? If I’m an Eastern Canadian based manufacturer/exporter, I’m pretty scared right now.

So what about the energy sector, surely it can’t be that bad there? Prices are rallying, discounts are narrowing, US refineries lover our heavy crude! Well, there are much more detailed treatises on the possible impact to the energy sector so I won’t go for too deep a dive, but suffice it to say it won’t be pretty.

Imagine if you will, you are the Canadian oil patch and you send 4 million barrels a day of crude to Gulf Coast refiners at some already discounted to WTI Canadian price. All of sudden these refiners can’t deduct the cost of that crude, but there is plenty of slightly higher priced US domestic production via tight oil they think they can get their hands on, so the price for Johnny Canuck Select will either need to be discounted more to account for that tax differential or it will need to ship elsewhere. But as a producer you can’t discount the price anymore if you want to, I don’t know, make money and we all know the export situation.

Look, I know no one (except for few hyperventilating analysts) really thinks the US can actually develop enough production to fill the import gap (I sure don’t) and there’s the whole Free Trade Agreement and proportionality for energy exports and all that. However, Trump has already promised to “rip up” NAFTA and there are probably a bunch of countries (hint – they all rhyme with Venezuela) that would gladly accept a whole bunch of discounts on their oil in exchange of volume if this tax plan were to be implemented and the Kool-Aid on shale is pretty potent.

So the reality for Canada is that we have limited recourse because as a country, we have gotten fat on trade with American have been too lazy to build export capacity to other countries. Our hands are tied until some recently approved projects get going.

Ultimately the end result for everyone is that the price for commodities and gasoline goes up – with number crunching estimates in the $0.30 a gallon range, which is, politically, a non-starter in the United States – so there’s that hope. However, what this whole exercise does is underline yet again the folly of putting all your export eggs in one economic basket when you see how easily a shifting wind can trip up a nation’s prosperity.

So if you are a Canadian government, you have an incoming US administration that is ideologically your exact opposite, that wants to rip up the most powerful, economy-building trade agreement in the history of your country, is committed to dropping personal taxes well below what your rates are, is committed to dropping corporate taxes a full 8 points on average below a comparable Canadian rate and is toying with a soul and economy crushing border tax (sorry, Destination Based Cash Flow Tax) – these are not Sunny Ways. Against that reality, you need to figure out pretty quick what you can do to keep Canada in the game, because this policy isn’t a one-off, it’s a message as to how your largest and most important trading partner is thinking, and I’ll just come out and say it – a carbon tax isn’t the answer – Canada is going to need to prepare to meet fire with fire, tax cut with tax cut and negotiate hard on trade and protect out interests.

The only saving grace for the export sector is a likely rapid appreciation of the US dollar, but throughout the rest of the economy, we get so many of our imports from the US, that all of a sudden the cost of living is through the roof! If you thought $6.99 for a pint of strawberries was highway robbery, just wait. The consumer will get crushed.

Life in the Canadian bubble is about to get rudely popped.

Now, do I think the Border Tax (sorry, Destination Based Cash Flow Tax) will happen? Well Trump has already come out and said it is too complicated, which thankfully it is, so I think the battle lines are being drawn internally. And ultimately, I think as a policy instrument it seems to me too blunt and not sexy enough to satisfy the Trump administration’s desire for symbolic and targeted gestures. Being able to slap a tariff on Chinese circuit boards or threatening a tax on cars from Mexico will play way better on Main Street than a pedantic, rules-based, paperwork-heavy sucking and blowing tariff/subsidy hybrid that gets econo-geeks all excited. Plus, I can just imagine the reaction from former Exxon CEO and soon to be Secretary of State Rex “Sexy Rexy” Tillerson when Paul Ryan tries to explain to him why this is such a good idea – we all know the Rex “stare” from watching the confirmation hearings – it’s withering. Also, with so many of the border-states that elected Trump economically dependent on exports to Canada, there will be political pressure to soften the blow for America’s hat. So no, I don’t see it happening in its current form, but it’s alarming enough that it has gotten this far with so little discussion.

Then again, I picked Hillary. And Kansas City. So beware.

And if I’m wrong? Be prepared for a $0.60 Canadian dollar and a recession. The only silver lining if we call I that is that if all the environmentalists were right and the Keystone XL was just a way to funnel Canadian crude to the Gulf Coast for immediate export, we skirt the Border Tax (sorry, Destination Based Cash Flow Tax ) with those barrels, so I suppose I can live with that. In which case – where’s my pipeline?

Prices as at January 20, 2017 (January 13, 2017)

- The price of oil dipped early in the week then rallied at the end of the week on improving confidence about OPEC cuts.

- Storage posted an increase

- Production was flat

- The rig count in the US and Canada continues to grow

- Natural gas was volatile during the week as milder weather reduced bullish sentiment and pushed prices lower, notwithstanding solid draws

- WTI Crude: $52.42 ($52.49)

- Nymex Gas: $3.204 ($3.415)

- US/Canadian Dollar: $0.7517 ($ 0.7623)

Highlights

- As at January 13, 2017, US crude oil supplies were at 485.5 million barrels, a increase of 2.4 million barrels from the previous week and 30.3 million barrels ahead of last year.

- The number of days oil supply in storage was 29.1, behind last year’s 29.5.

- Production was down for the week by 2,000 barrels a day at 8.944 million barrels per day. Production last year at the same time was 9.235 million barrels per day. The change in production this week came from flat Alaska deliveries and a small decline in lower 48 production.

- Imports fell from 9.052 million barrels a day to 8.378 (this is still high by the way), compared to 7.779 million barrels per day last year.

- Refinery inputs were down during the week at 16.468 million barrels a day

- As at January 13, 2017, US natural gas in storage was 2.917 billion cubic feet (Bcf), which is 3% below the 5-year average and about 13% less than last year’s level, following an implied net withdrawal of 243 Bcf during the report week.

- Overall U.S. natural gas consumption was down by 22% during the week as cold weather dissipated and demand fell across all sectors

- Production for the week was up 1% and imports from Canada fell by 3% from the week before in response to cold weather

- As of January 16, the Canadian rig count was 306 (47% utilization), 219 Alberta (49%), 32 BC (45%), 48 Saskatchewan (42%), 7 Manitoba (47%)). Utilization for the same period last year was about 30%.

- US Onshore Oil rig count at January 20 was at 551, up 29 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was up 6 at 142.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 56%/44%

- Offshore rig count was down 1 at 24

- Offshore rig count at January 1, 2015 was 55

Drillbits

- EXXON-Mobil paid $6.6 billion to acquire a significant 275,000 acre footprint in the Permian from the Bass family

- Noble Energy (NBL) acquired the Permian assets from Clayton Williams (CWEI)

- Anadarko sold Eagle Ford acreage for $2.3b to Sanchez Energy (SN).

- TransCanada was given approval on two pipeline projects in the United States – the Leach Xpress and Rayne Xpress which will connect Marcellus shale gas production with important Northeast markets

- This is from the “pretty cool file”. Statoil ASA is field testing in its Eagle Ford operations an Internet of Things (IoT) device that continuously monitors methane emissions. The device, is solar-powered and works remotely. The device was designed and deployed through the Methane Detectors Challenge – a partnership between the Environmental Defense Fund (EDF), Statoil and other oil and gas companies, U.S.-based technology developers and other experts. Statoil will evaluate the technology under different conditions with the goal of detecting leaks at production sites and will deploy the technology across various onshore facilities to further qualify the technology. Methane is a much more powerful greenhouse gas than CO2 and it is said that fixing the “fugitive emission” methane problem would be the equivalent of closing a third of the world’s coal plants.

- An assessment of the total financial impact of last spring’s Fort McMurray wildfire is pegging the direct and indirect costs of the blaze at almost $10 billion. The $9.9-billion figure includes the expense of replacing buildings and infrastructure as well as lost income, profits and royalties in the oilsands and forestry industries

- Trump Watch: He is now the President of the United States.