Ever get one of those weeks when not much of any substance happens and there is a lot of sitting around and thumb twiddling? Well I just had one of those. I am not even close to being fired up about anything today, so it is going to be stretch to find anything to rant about. Which may be a good thing. Although, why not a bit of manufactured outrage?

But about what? I’ve already done the tax change thing so that’s out, although I had a whole employee discount tax thing ready to go before the Liberals went and got some sense on that front.

I’ve also done Energy East a couple of times and reserve the right to keep being cranky about it. To be honest, I was super mad about that but I can get over it provided a bunch of people in Nebraska can get over KXL, which was the original TCPL plan all along.

I’ve done LNG, and that whole, slow motion unfolding disaster.

I’ve done “international capital is fleeing”, I’ve lambasted every level of government I can think of – right, left, provincial, federal, municipal.

I’m all out.

So, you have to wonder, what other things are there to complain about? Is there anything left for the federal government to cough up a hair ball on? There’s not much left, right? Deficits, debt, broken promises, cash for khadrs, bailouts for bombardier, the Phoenix pay system, stalled infrastructure, carbon tax, income tax, tax and more tax.

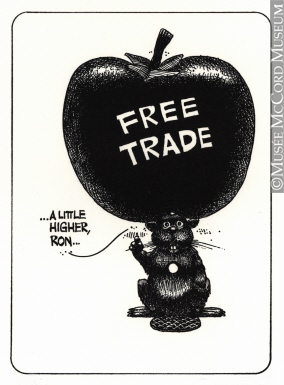

I mean, it’s not like we could possibly see any more damage done to the Canadian economy while they are in power, right? Seriously, it’s not like we are on the verge of losing the single most important trade agreement Canada has ever entered into, are we? Are we? ARE WE?

First a segue – I read somewhere the other day that in order to stay in power and be re-elected a Federal government really only needs to ensure two things: 1) Quebec doesn’t separate under their watch and 2) the economic relationship with the United States is maintained in proper working order.

The Liberals are experts in getting and maintaining power. There is no way they don’t get that truism. So how’s that working for young Justin these days? On the first item – check, Quebec isn’t going anywhere anytime soon (Alberta on the other hand, well that’s a story for another day, but I’m not convinced he would care).

On the second point, well… I’m not so sure anymore and that has to have the natural governing party of Canada in a state of full-on panic.

As of today, there is a very real risk that Donald Trump will pull the pin on NAFTA, mainly because that was his plan all along, but also because it’s “the worst deal ever” (or was that the Iran Nuclear Deal? Or TPP? There are so many worst deals!) and, ultimately, he appears to hate Mexico and doesn’t seem to care if he runs over Canada in the process of poking Mexico in the eye with a trade stick.

Isn’t that awesome? We have the world’s longest undefended border across which flows the highest amount of bilateral trade on the planet, yet we are suddenly staring at losing our favoured trading status with the giant next door and, let’s face it, there’s no real back-up plan. Look, I’m not blaming the Liberals for this, it’s the Trump show through and through, and the lack of a back-up plan is pretty much dictated by our geographic realities, but this is a BIG DEAL and elections will be won or lost on the outcome.

And it appears, on the surface at least, that no matter how much Donald Trump professes his admiration for our young, healthy haired international superstar prime minister, at the end of the day we are pretty much powerless. Not least because decisions are made on the basis of pleasing a base that doesn’t appear to have the intellectual capacity to see how they benefit from a trade agreement.

Just as an aside, for the life of me, I can’t figure out what is so bad about NAFTA from the US perspective and I would love for someone to educate me. An absolutely serious request – call me. All you hear from the Trump camp is “trade deficit bad” to which the only thing you can say is “I agree, our RECORD trade deficit with the United States is probably a bad thing”. What’s the problem? And it seems that concern over NAFTA (if people even know it exists) is pretty much confined to the Oval Office and some remote corner of Alabama.

Case in point – a letter was submitted to the president this week signed by more than 310 Chambers of Commerce in the United States asking him to please not wreck this trade deal. You would think a “business” oriented president would pay attention to the words that represent such a large swath of the economy. Some of their points include the fact that Canada and Mexico purchases account for more than half of US exports of manufactured goods (more than the next 10 combined), trade in goods and services amounts to $3.3 billion a day or $1.2 trillion a year and supports more than 125,000 small and medium businesses across all sectors of the economy from high tech to manufacturing to services to agriculture. That’s a big deal isn’t it?

But NAFTA is a weird thing. It’s an agreement that didn’t have massive support when it was signed that has been hugely successful. It gets limited popular support because, let’s face it, it’s boring. Who cares about duties on celery when someone in Hollywood is melting down or some random football player is kneeling? So it’s an easy target for the anti-trade, protectionist crowd looking to restore America’s manufacturing heartland, all the while missing the point that without the trade deal and the markets it has created, the manufacturing decline likely looks a lot worse.

The final, and maybe biggest problem as I see it is that NAFTA was originally signed by Bill Clinton, which of course suggests that Hillary was somewhere in the vicinity, meaning it’s all her fault and it needs to go away. The only way it could have been a worse deal is if Obama had also signed it – which he might have, if he hadn’t been in Kenya at the time at his madras.

Sorry – bit if a digression.

So what’s the likely path ahead of us?

First off, let’s be clear, Trump can’t unilaterally quit NAFTA on his own, which probably makes him mad as Congress has the final say! But he can take certain administrative steps to initiate a process to leave the agreement, and just by taking some of those steps, it may become a self-fulfilling prophecy.

And what happens if NAFTA gets dumped? In simple terms – lots.

Panic in export oriented businesses in Canada (which is pretty much the entire economy, right?). The unwinding of decades-old supply chains that see auto parts cross the border multiple times before they end up in cars rolling off the assembly line. I read somewhere it could mean 50,000 job losses in the auto parts sector. IN THE US! And this is a desired outcome? It will also mean a lot less traffic on the Ambassador Bridge that connects Windsor and Detroit – the busiest trade bridge between Canada and the US, meaning in the world. And a lot less traffic for the new bridge, which Canada is paying for by the way, because free trade necessitated it.

I would also anticipate a swift and punishing reaction to the broad basket of export oriented stocks on North American exchanges – bringing a rapid and permanent halt to the runaway stock market that the Donald is so enamoured with.

With no back up plan, all three countries would have to retreat and figure out the new rules of the game, introducing massive uncertainties into the market and, quite possibly, triggering recession which would be super-inconvenient what with rising interest rates and inflation

But really, isn’t it that uncertainty that is the most soul-crushing? I mean, if you are a business owner and you don’t know the rules of the game or they keep changing and the changes seem spurious, random and more than a little mean-spirited, doesn’t that affect how you plan your business and invest your capital? The NAFTA agreement made trade between Canada and the US and Mexico something unique and special in the world and thus attracted investment capital to all three countries. Scrapping it changes the calculus, moves the money elsewhere – the effects would be felt for generations. And for what gain?

Ultimately, no one has all the answers and the preceding is entirely my view, but it’s fair to ask the question in light of all the things I enumerated previously – does the government have a clue? This type of assault on our economic well-being is unprecedented and I am beginning to have my doubts that anyone in Canada is really up to the task. Economic nationalism of the type we are seeing in the US isn’t the same as off the shelf protectionism and, I would venture, requires a much more confrontational style to secure our interests – especially when the agenda is being set by someone who is a bit of a bully. What I will say is that the laissez-faire attitude by the federal government and much of the country towards the 15% of the economy represented by energy and energy infrastructure is unconscionable in the face of what could happen to the rest of Canada if NAFTA were to be scrapped. What’s the NAFTA plan guys? You clearly didn’t have one for energy. If you don’t have one for this, admit it and ask for help before it’s too late . If you do have a plan, share it. We all have a stake in the outcome.

Final point – Wouldn’t it be great if we had a few privately funded multi-billion dollar mega-projects kicking around that would allow us to lessen our dependence on the unpredictable side-show south of the border? You know, like LNG for export to Asia or pipelines to tidewater to allow the export of oil to … Asia, or aggressively developing the Ring of Fire to allow the export of minerals to… Asia… Wouldn’t that be great?

Energy East – An Obituary

It is with heavy heart that we announce the passing of Energy East, son of TransCanada, who died prematurely at the age of six on October 5, 2017 after a brief 30 day illness. While often maligned by political opportunists and often misunderstood, Energy East was a tireless nation builder and at the time of its passing was proposing to offer employment to many thousands of people across the country. A new breed of practical environmentalist, Energy East believed firmly that the best place for a barrel of oil was in a long steel tube, made to the most exacting and exhausting technical standards, many thousands of miles long in a closed system as opposed to being loaded into rickety, poorly regulated rail cars prone to derailment and explosion. To prove that point, Energy East was willing to put its money where its mouth was and allocate billions of dollars to that proposition.

During its brief time with us, Energy East was able to generate more than 30,000 pages of schematic drawings, environmental studies and other pieces of useful information, all in both official languages. An avid traveller, Energy East made stops across the country including Alberta, Saskatchewan, Manitoba, Ontario, Quebec and, of course, New Brunswick.. Notwithstanding the cool reception it received, Energy East always kept a soft spot for Montreal where Energy East felt its role as feedstock for the second largest refinery in Canada and mitigator of crude tankers plying the mighty and precious Saint Lawrence River would see it welcomed with open arms.

Energy East is survived by its cousins TransMountain Express, Keystone XL and Line 9. Energy East was pre-deceased by another cousin Northern Gateway. Amongst friends mourning its loss are countless small and mid-sized businesses across the country and pretty much the entire energy sector in Western Canada as well as Canada’s economy.

In lieu of lost taxes and investment, please send a donation to the Federal Government.

No service is planned, however participants are encouraged to gather in groups small and large to complain vociferously.

Energy East has asked for the following quote from the Phantom Tollbooth by Norton Juster to be inscribed on it memorial stone:

“So each one of you agrees to disagree with whatever the other one agrees with, but if you both disagree with the same thing, aren’t you really in agreement?”

Prices as at October 13, 2017 (October 6, 2017)

- The price of oil fell during the week as markets resumed worrying about inventory before rallying at the end of the week due to a bit of geopolitical risk

- Storage posted a surprise decrease

- Production fell

- The rig count in the US declined

- Natural gas rose during the week

- WTI Crude: $51.35 ($49.25)

- Nymex Gas: $2.991 ($2.865)

- US/Canadian Dollar: $0.8014 ($ 0.7934)

Highlights

- As at October 6, 2017, US crude oil supplies were at 462.2 million barrels, a decrease of 2.8 million barrels from the previous week and 11.8 million barrels below last year.

- The number of days oil supply in storage was 29.1 behind last year’s 29.4.

- Production was down for the week by 81,000 barrels a day at 9.480 million barrels per day. Production last year at the same time was 8.450 million barrels per day. The change in production this week came from an increase in Alaska deliveries and lower Lower 48 production.

- Imports rose from 7.214 million barrels a day to 7.617 compared to 7.861 million barrels per day last year.

- Exports from the US fell to 1.270 million barrels a day from 1.984 and 0.826 a year ago

- Canadian exports to the US were 3.442 million barrels a day, down from 3.559

- Refinery inputs were up during the week at 16.258 million barrels a day

- As at October 6, 2017, US natural gas in storage was 3.595 billion cubic feet (Bcf), which is marginally lower than the 5-year average and about 4% less than last year’s level, following an implied net injection of 87 Bcf during the report week.

- Overall U.S. natural gas consumption was up 7% during the week, mainly on electricity demand due to weather

- Production for the week was down 2%. Imports from Canada were down 2% compared to the week before. Exports to Mexico were up 3%.

- LNG exports totalled 18.4 Bcf.

- As of October 10 the Canadian rig count was 190, 137 Alberta, 27 BC, 22 Saskatchewan, 4 Manitoba. Rig count for the same period last year was 160.

- US Onshore Oil rig count at October 13 was at 743, 5 less than the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was down 2 at 185.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was down 2 at 20

- Offshore rig count at January 1, 2015 was 55

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 56%/44%

Drillbits

- In an otherwise quiet week, Alberta saw land sales prices that haven’t been experienced since 2014 when oil was $100 a barrel. For the period, the government received in excess of $125 million, mostly in the Plains region which encompasses the emerging East Duvernay tight oil play. Many government people in Edmonton breathed a sigh of relief, in case you were wondering why it was so windy

- Trump Watch: Two steps forward, 4 steps sideways, 3 steps backwards with a pirouette, 1 skip, a little jog. Not sure what to make of the week. All I know is Iran bad, Sidney Crosby – winne