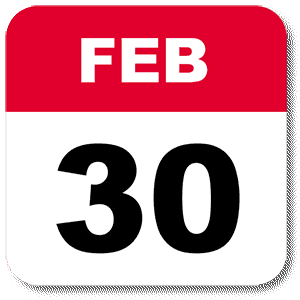

OK, a bit of a different spin this week as I have been a bit busy trying to do my actual day job! First off, the date. February 30th is one of my favourite days of the year – I’ve always found that the dog days of February, namely the 30th and 31st are among the coolest days of the year where the fog of winter starts to give way to overwhelming anticipation of a sunny, happy spring. Or is it a reflection of the drudgery of a winter that seems to have no end.

Look, I know what you’re thinking – I’ve been out sampling some of that soon the legalized BC premium bud – winter sucks, right?

And what? February doesn’t have 31 days? I’m looking at my watch and it clearly says 30 on the day counter thingy.

So you’re telling me it’s a “Fake Day”? Hmm, well that’s kind of embarrassing. Also explains why I am always a couple of days late for everything in the later parts of the year.

Of course now this makes me think. If February 30th is fake, then how many other days are fake? Probably worth a look.

The Day Canadian Energy Ceases to Exist

I touched on this in last week’s blog but it bears repeating. Lots of people, particularly in the environmental movement are in a big hurry to say that the Canadian Energy sector, primarily oil and gas, has had its day and that someday soon, it will be all be over. Others use the relative decline of the energy sector vis a vis the United States to score political points against opponents whom they accuse of scaring investment away from Canada for a variety of reasons.

As we all know, each argument has some merit. The transition to renewables is indeed driving change in the Canadian energy mix, especially on the generation side as, for the most part, coal finds itself increasingly passed over for cleaner burning natural gas and a mix of hydro, wind, solar and geothermal. But let’s not get carried away. Sweeping, blanket statements display a rather naïve understanding and grasp of both the nature of the energy industry and its scale.

Likewise those who argue from other side – that (current) government action is responsible for cratering the entire sector have a bit of a point as well, although the reality is a bit more subtle than that. It is true that there are policies and regulatory and fiscal changes and uncertainties that drive away investment, but ultimately, the biggest determinant in the economics of any energy project is the difference between the cost to produce and the proceeds from sale. Right now, Canadian projects suffer from the former being too high and the latter being too low.

And ironically, those who decry the demise of the Canadian energy industry through poor policy decisions actually do a good job of playing into the hands of those who want it to go away. After all, if no one is investing in Canada, it’s over right?

Wrong. The reality is one of the largest producers of oil and gas in the world. We export 3.5 million barrels of oil a day to the United States, that isn’t going to stop, it’s going to grow. We produce an abundance of natural gas and have sufficient reserves to support a thriving LNG industry for decades.

The day that is the end of the Canadian energy industry is not coming anytime soon.

The Day the Pipelines are Stopped

Again, this is a fake day. It has been discussed ad nauseum in this column and others. And as much as people hope that these projects are all brought to their knees, the likelihood that they will be stopped at this stage is getting smaller and smaller. This is notwithstanding the efforts of the BC government, environmental activists, US backed special interest groups and the Muppets.

The Day America Achieves Energy Independence

A long stated goal of the United States government is to achieve total energy independence. This includes fuel for electricity generation as well as transportation and other fuels. While the US is a net exporter of natural gas and does now export significant volumes of oil, it does nonetheless import significant volumes of heavy oil from Canada, Mexico and other countries and as stasted above this isn’t likely to change for generations. So, while no doubt a noble goal for global security purposes, the reality is that the US is part of an integrated North American energy complex that could conceivably within the next decade provide continental energy independence. Provided of course we don’t screw it up with unnecessary tariffs, trade wars, scared-off investment, regulatory over-reach, incompatible fiscal regimes, out of control special interest groups and general tomfoolery.

Pretty tall order right? Maybe not 100% achievable, but I’ll give it 85%, just because.

The Day of the Triffids

The Day of the Triffids is a 1951 post-apocalyptic novel by the English science fiction author John Wyndham. After most people in the world are blinded by a meteor shower, an aggressive species of plant starts killing people.

Fake Day I think

The Day the Carbon Tax Killed Canada’s Energy Industry

I find this one hard to believe. There are enough accommodations in the current regime in BC and Alberta for the energy industry to adapt and survive. The purpose of the carbon tax is to incent change primarily on the consumer side, whether through efficiency, switching or adaptation. The reality is that energy will always need to be produced in whatever form. So the fossil fuel industry, if it wants to retain its share of the consumer market will need to adapt. It will reduce its own consumption of fuel to reduce its carbon footprint and users will develop ever more efficient ways to use these fuels. Think about it – if I could produce for you an internal combustion vehicle that had the same production to scrapyard carbon footprint and mileage efficiency as an electric vehicle at half the cost, which option would you choose? I’d take the former, but then I’m not a hypocrite. Carbon taxes are here to stay, don’t fight it, adapt and overcome. Fake Day!

The Day Gun Control Starts to Get Traction in the United States

It’s a stretch right? Given the last twenty years or so, it’s hard to see this. And it’s certainly not likely to happen with Donald Trump in the White House for sure. Wait, what? It seems like it is? Wow. I don’t think anyone could have seen that coming. Let’s see what Congress and the Senate can do.

International Bacon Day

Is this even worth discussing? I mean, it’s bacon right? If there isn’t a day, then we will make one. Perhaps we will make many. Maybe EVERY day should be bacon day.

Judgement Day

Your call.

Wow. Bit of a downer that last one, eh? How about a Canadian limerick. Or a limerick about a Canadian. Or a limerickal ode to the theatre of the absurd that has suddenly taken over our political discourse. You should know in advance I am very bad at limericks.

There once was a boy named Trudeau

Who liked all his costumes just so

He travelled the world

With his turban unfurled

Thinking “look at me, I’m so special you know”

Prices as at February 30, 2018 (February 16, 2018)*

- The price of oil held fell during the week after last week’s rally along with the stock market on a series of bad news events including the absurd steel tariff annoucenment

- Storage posted an increase

- Production was up marginally

- The rig count in the US was mixed

- Despite another large withdrawal, natural gas remained in the doldrums – expect continued volatility…

- WTI Crude: $61.40 ($61.65)

- Nymex Gas: $2.711 ($2.564)

- US/Canadian Dollar: $0.7760 ($ 0.7968)

*I can’t believe I forgot to update prices last week. Many apologies for this serious oversight.

Highlights

- As at February 23, 2018, US crude oil supplies were at 423.5 million barrels, an increase of 3.0 million barrels from the previous week and 96.7 million barrels below last year.

- The number of days oil supply in storage was 26.2 behind last year’s 33.4.

- Production was up for the week by 13,000 barrels a day at 10.283 million barrels per day. Production last year at the same time was 9.032 million barrels per day. The change in production this week came from a marginal decrease in Alaska deliveries and a marginal increase in Lower 48 production.

- Imports rose from 7.021 million barrels a day to 7.282 compared to 7.589 million barrels per day last year.

- Exports from the US fell to 1.445 million barrels a day from 2.204 last week and 0.721 a year ago

- Canadian exports to the US were 3.219 million barrels a day, down from 3.523

- Refinery inputs were down during the week at 15.882 million barrels a day

- As at February 23, 2018, US natural gas in storage was 1.682 billion cubic feet (Bcf), which is 18% lower than the 5-year average and about 29% less than last year’s level, following an implied net withdrawal of 78 Bcf during the report week

- Overall U.S. natural gas consumption was flat during the report week, influenced by weather

- Production for the week was up 1%. Imports from Canada were up 4% compared to the week before. Exports to Mexico rose 1%.

- LNG exports totalled 17.6 Bcf.

- As of February 30 the Canadian rig count was 302 – 208 Alberta, 23 BC, 62 Saskatchewan, 6 Manitoba and 3 elsewhere. Rig count for the same period last year was about 270.

- US Onshore Oil rig count at February 30, 2018 was at 800, up 1 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was up 2 at 181.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was down 3 at 14

- Offshore rig count at January 1, 2015 was 55

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 70%/30%

Drillbits

- President Trump announced new tariffs on imports of steel and aluminum into the Untied States. Market and industry reaction was swift and decidedly negative. Canada is seeking an exemption to the new U.S. trade restrictions and is vowing to retaliate if it’s slapped with any new tariffs. These tariffs are fairly ill-advised as it regards the enegry sector where an integrated supply chain will be severely impacted and costs in the Permian are likely to increase due to higher prices. This is particularly the case for tubular production where there are no mills with the capacity or technical ability to produce the specialized pipe used in large transportation projects. But what do we know.

- Newalta Corporation and Tervita Corporation announced that they have entered into an arrangement agreement to combine their businesses and create a leading publicly traded energy-focused environmental solutions provider in Canada providing waste processing, treating, recycling and disposal services to customers in the oil and gas, mining and industrial sectors.

- The Alberta government announced an investment of up to $1 billion in direct grants and guarantees to the oil patch. Premier Notley said Monday that the money will be used for loan guarantees and grants to attract anywhere from two to five partial oil bitumen upgrading facilities resulting in $5 billion in private investment. The jury is out…

- Canada’s largest integrated energy company has filed an application for a massive new project defying expectations of slowing growth in the oilsands. The company is seeking regulatory approval to build a 160,000-barrels-per-day steam-based oilsands project north of Fort McMurray called Lewis. The project would not require federal approval from the National Energy Board, which Ottawa is currently reorganizing. The cost of the project is estimated to be $6.2 billion. Woot!

- Calgary-based STEP Energy Services Ltd. says it will enter the U.S. oil and gas well-fracking market by buying Tucker Energy Services Holdings, Inc. for about $350 million in cash before closing adjustments. The privately owned Tucker operates primarily in Oklahoma, where it has three crews offering pressure pumping services to hydraulically fracture wells and is expecting to add a fourth in the second quarter of this year.

- Trump Watch: Tariffs! Trade War! Hope Hicks resigns! What is going on????