Short stuff this week as I know most people are off for the Easter weekend and don’t want to be bothered with having to think about the industry much. So I will therefore try to keep it simple and, possibly, use pictures. Like the cute rabbit you already see.

Last year, on Good Friday, which by the way was super early in March as opposed to this year when it’s super late in April, I mused about what was happening the last time Easter was that early (2008) and so I suppose I should muse about what life was like the last time Easter was this late, which was in April of 2014 – a great and heady time for the oil and gas world and service companies, BUT I WON’T!!!

Do you know why? Because thematically it would represent the fourth blatant rip off of a theme from last year. Well, yes, ahem, there is that.

But do you really want to know why?

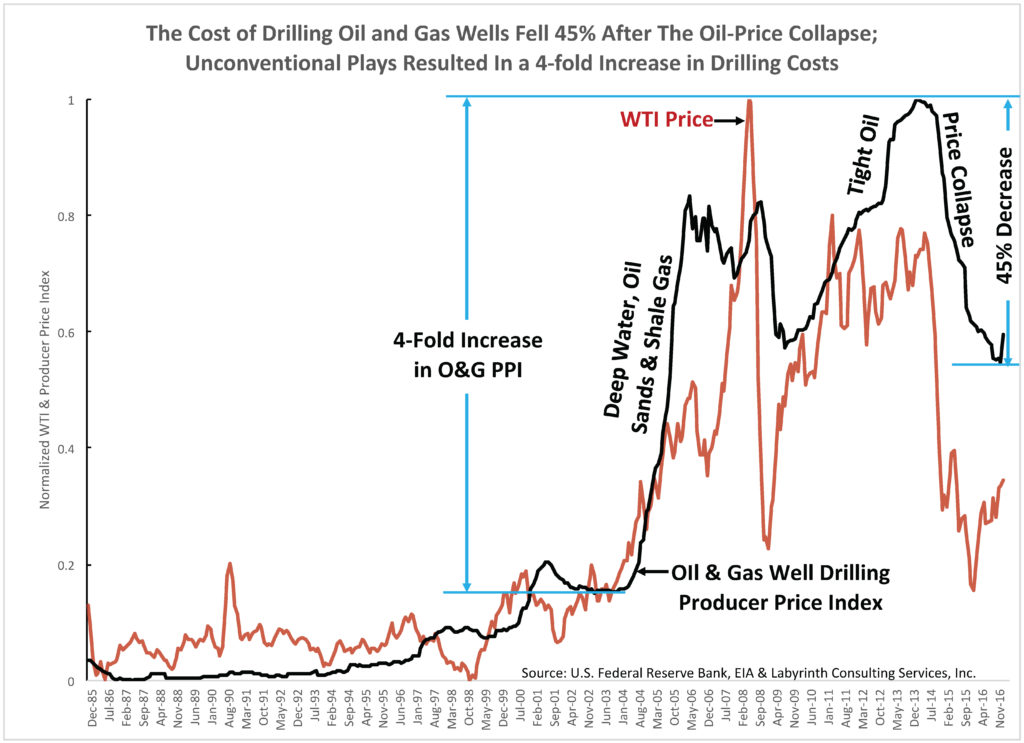

Because I love this graph!!!! Do you know why I love this graph? Because it has so much relevance to the energy story in North America and says so much about “efficiency” and all that clap trap. Plus, there is a fairly distinct 2014 element to it.

The graph shows the price of WTI and, man I wish I had found this sooner, the Producer Price Index for oil and gas drilling services. How sweet is that? For the uninitiated, the PPI is a measure of cost inflation, and, in the case of this particular industry, deflation as well.

In a nutshell what the graph shows is… wait for it… high prices lead to cost inflation and low prices lead to deflation. Pretty basic right? But what struck me is the magnitude of the changes and the striking correlation with oil prices, and it goes without saying that we know which index is correlated with the other. As a side note, I overlayed rig count on the graph for fun and guess what? Yup. same shape.

It’s also a mini history lesson as we can see the economic cycle play out next to oil prices as they start to accelerate around 2004, big spike in 2008 and subsequent “Great Recession” then the reinflation and second run up in service costs with the pursuit of tight oil and shale gas and then, well we call it 2014.

Post 2014 we see the price of oil collapse and with it the evisceration of the service sector and the loss of pricing power, to the tune of a 45% decrease in the index since 2014.

This speaks to something that has been discussed in here many times – efficiency and technological improvements are great and have led to significant productivity gains among the wells drilled in high graded locations, but as the graph shows, unconventional drilling is expensive and post 2014, a significant amount of the efficiency gains have come at the expense of the service companies who have been forced to cut costs below their own break even to help these Permian and other operators lower their costs to keep drilling at lower costs. This can’t be ignored.

So here we sit, looking at a graph that seems to imply that the cost to drill a well in 2016 is about the same as it was in 2008 – an entire cycle ago. Or put another way, service companies are being paid what they were a decade ago and with prices rising and rig count rising, this is, in my view, completely unsustainable and will act as the regulator on the reckless increases in production that everyone seems to be forecasting.

And it’s already happening, if you look at the tail of the graph and a smart uptick for February, the last period on this chart. In fact, I read another article earlier this week that said the PPI for the Marcellus was up a whopping 8.7% in March! In March! In the Marcellus! That isn’t even oil – it’s cheap, plentiful, ignored natural gas country! You can bet producers operating in the Permian are due for a bout of “efficiency adjustment”, as are all the other currently popular plays, including the ones in Canada.

The flip side?

The commodity price is rising, inventories are being worked off and activity levels are on the upswing. In that environment, service companies are able to raise prices and start making money again for the first time since the PPI and WTI fell off a cliff in 2014.

And that, for us and the majority of you, our readers, makes for a very Good Friday indeed.

Prices as at April 13, 2017 (April 7, 2017)

- The price of oil held steady early in the week on OPEC optimism, Libya supply disruptions and bombing fallout.

- Storage posted a modest decrease

- Production was up marginally

- The rig count in the US continues to grow, although at a slower pace

- Natural gas was weak early in the week on milder weather but rallied toward the end of the week

- WTI Crude: $53.18 ($52.24)

- Nymex Gas: $3.2227 ($3.260)

- US/Canadian Dollar: $0.7511 ($ 0.7464)

Highlights

- As at April 7, 2017, US crude oil supplies were at 533.4 million barrels, a decrease of 2.1 million barrels from the previous week and 28.2 million barrels ahead of last year.

- The number of days oil supply in storage was 32.7, behind last year’s 33.3.

- Production was up for the week by 36,000 barrels a day at 9.235 million barrels per day. Production last year at the same time was 8.977 million barrels per day. The change in production this week came from a small increase in Alaska deliveries and increased Lower 48 production.

- Imports rose slightly from 7.850 million barrels a day to 7.878, compared to 7.940 million barrels per day last year.

- Refinery inputs were up during the week at 16.697 million barrels a day

- As at April 7, 2017, US natural gas in storage was 2.061 billion cubic feet (Bcf), which is 15% above the 5-year average and about 17% less than last year’s level, following an implied net injection of 10 Bcf during the report week.

- Overall U.S. natural gas consumption was down by 7% during the week – broadly based

- Production for the week was flat and imports from Canada fell by 4% from the week before

- As of April 10, the Canadian rig count was 120 (19% utilization), 92 Alberta (21%), 20 BC (28%), 6 Saskatchewan (5%), 0 Manitoba (0%)). Utilization for the same period last year was about 10%. With breakup now on, this count isn’t expected to rise significantly for the next month or so.

- US Onshore Oil rig count at April 13 was at 683, up 11 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was down 3 at 162.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was down 1 at 21

- Offshore rig count at January 1, 2015 was 55

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 56%/44%

Drillbits

- Really slim pickings this week. Stuff and things. Rumour is Chevron is looking to join the oil majors “sheeple” movement and divest some oilsands assets

- I guess pot is going to be legal in Canada? Ya man….

- Trump Watch: The fallout from the Syria bombing continued. HUD secretary Ben Carson got stuck in an elevator. All eyes are on the White House Easter Egg Hunt, a crucial measuring stick of presidential performance.