As some of you are reading this the price of oil has dropped below $26 a barrel which as we all know is the low it reached in February 2016. This is a remarkable fall from grace for a commodity that just a few short weeks ago was being pegged for a healthy run at $100 a barrel.

What? I’m wrong? It’s not below $26? What gives? Well it must be below $40. What with all the panic selling happening. Honestly, I’m still shocked but $40 has to be the floor right?

Still wrong? $50? No? $60? OK, good enough.

Wow, that’s low enough right? And still a big drop from pushing close to $70 a few weeks ago. What happened? Did WTI catch a case of the Canadas?

No, not quite. But it appears it may have caught a slight case of the Trumps.

What do I mean by this? Well if any of you read Trump tweets as religiously as I do, you will know that Trump absolutely hates OPEC. Loves Saudi Arabia. Hates OPEC. This hatred goes back many years. And recently he has been tweeting at OPEC that they need to up their production game. Why? Because high oil prices lead to high gasoline prices which lead to less votes in midterm elections. So someone needed lower oil prices. And OPEC+ complied, goosing production to make up the perceived shortfall and halt the rise in prices that, of course, had been caused by their own cutbacks in production. Sigh.

Adding to the shortages, someone went and imposed sanctions on Iranian oil exports and this same someone had already imposed sanctions on Venezuela, making that disaster just a little bit worse.

That all these sanctions were from Donald Trump himself is irrelevant. What matters is that when Trump tweets apparently OPEC blinks. Donald Trump got his lower prices for the midterms, but, as in all things oil, there are unintended consequences.

Turns out the Iranian sanctions aren’t as tough as initially feared and the US is producing so much LTO that maybe OPEC didn’t need to increase production. So suddenly we seem to have too much oil production and wouldn’t you know it, we suddenly have OECD inventories back above the five year average. Whoops.

So the market did what the market does – cashed in pretty much its entire long position in oil, taking the price with it.

Well done fellas. It took almost four years to the DAY to climb out of the mess that you started and basically all of four days this week to unwind the whole thing. Well not on the price, but sure as taxes on the market sentiment.

These things can and do change that quickly.

So what’s a guy to do? Change professions? Maybe, but maybe not. As most of you know, I am on the record as being very bullish and constructive on oil prices going forward. Do I need to change my view? Will I change my view? I don’t think so.

Why not? Well because the fundamental story hasn’t changed. Four years of chronic under-investment has left the oil market bereft of substantive new discoveries. OPEC pumping at record rates to help a sitting US President get a leg up in midterm elections isn’t sustainable. The crisis in Venezuela isn’t over. Iranian barrels have come off. Demand is over 100 million barrels per day. As discussed here, the Permian is a piece of the puzzle but not the answer. Decline rates and depletion are an immutable fact of resource development. If anything, this pause in prices may serve as the catalyst to slow the demand destruction that was starting to take hold in the developing world on high prices and a rocketing US dollar and set the stage for the next leg up (assuming we can solve trade wars).

As they say, this too shall pass. I read where Jim Cramer says oil is going to $40. Last time he made a prediction on oil prices they went precisely the opposite direction. I’m OK with that.

Look, there is a case for oil price weakness for all the reasons above, but it’s driven by short term thinking. The direction for oil prices is up. What we are seeing is a drop in the price for lighter oil and a seasonal adjustment exacerbated by extraneous factors. Pay attention to what is happening with refineries and utilization – turnaround season is the fall, then we get busy again. Demand always weakens towards the end of the year then recovers – this is why turnaround season is in the fall in the first place. Pay attention to Iran and how the waivers actually play out – they aren’t a gift to Iran from a hawkinsh US, I can guarantee that. Pay attention to what is happening with Venezuela. Pay attention to what is happening with OPEC and OPEC + who are meeting this coming week and have already discussed in the media a potential reduction in exports. Pay attention to what is happening in the Permian, but not as much as all the other stuff. Pay attention to Canada, if only because we hate being ignored.

So how much should Canadians really care about a drop in the WTI prices? Notionally quite a bit, but crude quality matters. We care more about heavy oil. When the refineries come back on-stream, our price deck moves up regardless of the noise at the WTI level. Has it happened yet? Clearly not. Will it? For sure. The world is oversupplied with light crude (thank you USA) and under-supplied with heavy crude (thank you Venezuela).

We produce some light but mostly heavy oil. The market will rebalance. Maybe this time, for once, in our favour.

If only we had some shiny new pipelines…

Which leads me to a quick note on Keystone XL. Sigh.

This not officially sanctioned but under way project suffered a setback today as a Montana-based Federal judge ordered construction halted because the State Department’s analysis fell short of a “hard look” at the cumulative effect of greenhouse gases, indigenous impacts and the effect of prices on the viability of the pipeline. As discussed above, the prices are all over the map. The US needs heavy oil and is paying full pin for it from Venezuela, Mexico and OPEC. If ever the case for this pipeline was there, it is now. Anyway, my take? The judge is an Obama appointee and this decision is clearly political. Donald Trump has already indicated an intent to combat this decision through appeal. My money is with the Donald on this one.

Alright, now for a hard segue to some local content, feel free to skip…

First off, hands up everyone who lives in Canada? OK, now how many who live in Alberta? OK, that’s quite a few. Now, how many in Calgary? Ah, a fair number. You guys should stay. Everyone else can choose to stay or go, because I’m getting real local now. And unless you live under a rock, you know where I am going.

That’s right. The Olympics. Specifically the 2026 Winter Olympics and the upcoming, deliciously divisive plebiscite on whether Calgary should continue pursuing its Winter Olympic pipedream or do the fiscally responsible thing and drop it now before the IOC rips our collective hearts out anyway by awarding the games to a surprise last second bid from Saudi Arabia.

First off, let me be the first to say that the Olympics can no more go over budget than a man can have a baby. What? It’s been said before? Really? When? Oh right, Jean Drapeau. Before the Montreal Olympics. Which went just a wee bit over budget as I recall. And all Olympics go over-budget and this one will too and Calgarians will be in hock for decades. And think of the taxes!

Not the same! Supporters will say. Those were the Summer Olympics, much bigger. And besides Calgary had the Winter Olympics in 1988, and they made money – well not really, but they left legacy facilities that we are going to use and there was cash left over which went into a foundation which has served the athletic community well over the years.

The debate is pretty divisive.

Are the Olympics a great, big waste of money? A narrow celebration of elite sports in a two week party that costs the hosts billions of dollars with marginal economic benefit? Or… Are the Olympics a great unifier and a celebration of the unifying good of sport, as well as a job-creating machine and GDP multiplier.

Which is it? All of the above? None of the above? How do you decide?

In advance of the vote, I’ve been thinking about this a lot, as I’m sure many Calgarians have so I thought I might use this soapbox to take you on the random walk I have taken as I tried to make up my mind. Which means you need to humour me.

First off, I am nothing if not a realist. I take nothing at face value and the people on either side of the debate can scream at me until they are blue in the face but I’ll make up my own mind in my own way, as should everyone. I have read pretty much all the documentation that is out there – seriously, I’m a total loser right? This includes the bid plan, the cost benefit analysis, the funding documents etc. This doesn’t make me an expert, but it does mean I am more informed than I want to be. As a result, I have some thoughts.

The bid as it currently stands proposes to make use of existing legacy facilities as much as possible and has earmarked funds to bring all these facilities up-to-date. This is consistent with new IOC assessment criteria for the Games. There are a number of new facilities planned, the largest of which is a new fieldhouse which will have an ice-plant so it can be used for winter sports. There is also a plan for a new rink, which will hold about 5,000 people to host some of the other ice sports. The 30-plus year old Saddledome and the 250-year old McMahon Stadium will get some investment as will the Nakiska facility for skiing but there are no other significant new facilities planned. Ski jumping is expected to be held in Whistler BC where the facilities are up to modern standards. This part is weird, but so is ski jumping.

My first reaction to this was meh. I get that the goal of the bid committee was to keep costs down and recycle existing facilities, but quite frankly, the lack of aspiration in the bid left me feeling disappointed. Where is the glitzy new hockey barn? A new stadium to go with a new fieldhouse? Where is the LRT to the airport?

I know, I know. If I thought the Olympics as proposed was going to be a budget buster, then imagine how much my wish list was going to cost? But really, Vancouver got it, why can’t we?

Which of course, leads me to… The cost.

By now everyone should know the funding details. If you’re going to vote and don’t, then shame on you. How best to summarize it… The Olympics are going to cost a boat-load of money. And it is going to be taxpayers on the hook for most of it.

Based on the agreed deal, $390 million will come from the City of Calgary, $700 million from the province and $1.452 from the federal government. Otherwise known as the taxpayers. Further to that, there will be some $750 million from the IOC and the balance of the $5 billion’ish outlay will come from ticket sales and pin exchanges.

That, as they say, is a lot of dough for a short party.

Proponents of the bid will point to all the “free” money the City will get, celebrating the great deal of a 10 to 1 return on investment – all that spending in the city for a mere $390 million investment.

Opponents will of course say this is all smoke and mirrors and that the City, the province and the country are broke and that we are diverting much needed funds from more critical needs such as paving roads, building hospitals and saving the toads that get buried under new pipelines.

Proponents will point to the massive boost in the economy that can come from an Olympic games, with tourism, construction, and all the “spin-off” activity. More legacy facilities, affordable housing!

Opponents will point to near universally agreed economic studies that show that the Olympics are not in fact additive to GDP, they are just a reshuffling of economic activity that was going to happen anyway. The bid actually supports this theory as many of the refurbishing that is going to occur was already planned and the fieldhouse is on the City’s list of capital projects anyway.

Me? I think it’s somewhere in the middle. The only free money I see in the deal is the IOC contribution. So for a combined $2.5 billion’ish taxpayer investment, we get $750 million in money-laundered IOC cash that we wouldn’t otherwise see. Maybe an argument could be made that the federal money is something we wouldn’t see as it comes from Sport Canada specific to events but to argue we wouldn’t get a piece of that for Stampede or a Curling bonspiel is disingenuous.

So while it is no doubt a good deal for Calgary to have all this stuff built, let’s temper our enthusiasm because this is money that is coming from somewhere else. It is depriving one project to feed another. Municipally a bit of a win, provincially a little less so and nationally a wash.

Pretty glum, but I’m hard pressed to see the analysis differently. Financially the Olympics are a wash. If you can stay reasonably within budget, it’s an event that was pulled off within budget instead of another event.

But what about the games themselves?

Look, I have absolutely nothing bad to say about the Olympics – winter or summer. I love sports and I watch the Olympics whenever it is on. My family has an Olympic pedigree with and Uncle, aunt and cousin who all competed and participated in Olympic Games, one of whom carried the flag for the opening ceremony and one who had the opportunity to participate on home-soil, in Montreal.

But I completely understand the opposite position that the Games are a celebration of elite special-interest athletes.

So a lot of waffling. But where do I land when I think about the Winter Olympics and this bid? What comes to mind when I dust away all the cobwebs and come face to face with my own inner thoughts? It’s a conundrum.

Let’s run through the basic questions one more time.

Are the Olympics an elite athletic competition that is out of reach for a lot of people? Probably, but there are ways to address that.

Is the cost of the Olympics out of touch with the actual time of the event? Sure.

Are we diverting cash from one project to another for a pretty much zero-sum economic game. Yup.

Will it go overbudget? Wouldn’t be an Olympics if it didn’t.

Is it the most prudent use of taxpayer dollars and can we afford it? No and that’s subjective. If we had to spend all the money today? Not a chance. But eight years is a lifetime in the fiscal world. That’s an entire oil and gas cycle – peak to peak. Our current fiscal situation feels as bad as it can get. Who knows what we will be able to pay for in four or five years. It’s short-sighted to only look in today’s terms.

Will there be an Olympic hangover when it’s done? I sure hope so.

If we win the bid will Calgary put on a hell of a show? You bet.

Will I attend events, even if McMahon is still a cinder-block hellhole and we don’t have a shiny new arena to watch Belarus play Latvia in an irrelevant early round hockey game? You know it.

Will I volunteer. Yeah, probably.

Will my kids enjoy it? Absolutely.

All these questions. I’ve run through them all over and over. But when I think about this bid I can’t help thinking about something completely different.

What do I think of? I think of pipelines. I think of deeply discounted Western Canadian Select. I think of $0.11 AECO gas. I think of 35,000 jobs lost that may never come back. I think of the friends who are un or under-employed. I think of empty office towers. I think of rising homelessness in Calgary, rising crime rates and taxes. I think of what was, what is and what could be.

But most of all I think about how blue and morose and beaten down my adopted city is. I love Calgary. It’s a great, proud city and a wonderful place to raise a family. The weather isn’t the best but it makes for a hardy population. For the first 16 years I lived here Calgary was this big, bold, brash, in your face hotbed of can-do, outta my way attitude. For the last four, it has been, to be completely honest, a pretty downtrodden and despondent place to be. It has lost a lot of its mojo and has felt a bit hollow. And all of those things that I mentioned above – the pipelines, the prices, whatever – have conspired and contributed to keeping a good city down. The negativity from the extended slump has seeped into all aspects of our daily lives whether its politics, business, civil discourse or this bid. Something needs to change the narrative and break the cycle. The energy sector will recover and contribute but business is superficial, the reset needs to come from somewhere deeper.

To be quite frank, we don’t “need” the Olympics. But we need something. We need the goal of putting on the Olympics. We need the spark that comes with getting it done. We need to feel good about ourselves. We need something to think about aside from commodity prices, pipelines and how much we think everyone is conspiring against us. We need to show the rest of Canada and whatever parts of the world that pay attention to us that a city like Calgary isn’t going wallow in self-pity. That we can after four long years get up, dust off and get on with something we can all collectively own.

The cost to put on the show is high and probably irresponsible. But maybe the price to pay for not trying is that much higher. That’s where my gut is.

Go figure – I’m a yes.

Lastly – Remembrance Day

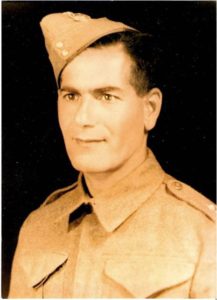

November 11th is Remembrance Day in Canada and Veterans’ Day in the United States. In honour of this day, I present two veterans and grandfathers who served their country but who (fortunately) did not pay the ultimate sacrifice, one born here (3rd from right holding flag), the other an immigrant from Lebanon (then Syria), both, as mentioned above, patriarchs of Olympic dreams.

Prices as at November 9, 2018, (November 2, 2018)

- The price of oil fell during the week on a combination of supply build, Iran and stock market jitters.

- Storage posted another big increase

- Production was up

- The rig count in the US was flat

- After a smaller than expected injection, natural gas was up slightly for the week…

- WTI Crude: $59.80 ($62.86)

- Western Canada Select*: $16.18 ($17.17)

- AECO Spot *: $3.20 ($0.80)

- NYMEX Gas: $3.721 ($3.257)

- US/Canadian Dollar: $0.7681 ($0.7632)

*Due to overwhelming interest, we are now including prices for Canadian commodities, in case you weren’t angry enough.

Highlights

- As at November 2, 2018, US crude oil supplies were at 431.8 million barrels, an increase of 5.8 million barrels from the previous week and 25.4 million barrels below last year.

- The number of days oil supply in storage is 26.4 compared to 28.7 last year at this time.

- Production was up during the week at 11.600 million barrels per day. Production last year at the same time was 9.620 million barrels per day.

- Imports rose from 7.344 million barrels to 7.539 million barrels per day compared to 7.377 million barrels per day last year.

- Exports from the US fell from 2.485 million barrels per day to 2.405 million barrels per day last week compared to 0.869 million barrels per day a year ago

- Canadian exports to the US were 3.507 million barrels a day, up from 3.190

- Refinery inputs fell marginally during the during the week at 16.408 million barrels per day

- As at November 2, 2018, the traditional end of injection season, US natural gas in storage was 3.208 billion cubic feet (Bcf), which is about 16% lower than the 5-year average and about 15% less than last year’s level, following an implied net injection of 65 Bcf during the report week

- Overall U.S. natural gas consumption was flat during the report week

- Production for the week was flat. Imports from Canada were down 11% from the week before. Exports to Mexico decreased 1%

- LNG exports totaled 18.2 Bcf

- As of November 3, 2018, the CAODC Canadian rig count was 306 (AB – 217; BC – 24; SK – 60; MB – 5; Other – 0. Rig count for the same period last year was 358.

- US Onshore Oil rig count at November 9, 2018 was at 886, up 12 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States were up 2 at 195.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was up 3 at 21

- Offshore peak rig count at January 1, 2015 was 55

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 65%/35%

Drillbits

- Encana/Newfield

- Trump Watch: Midterms – mixed success. Held the Senate, lost the house and fired the Attorney General.