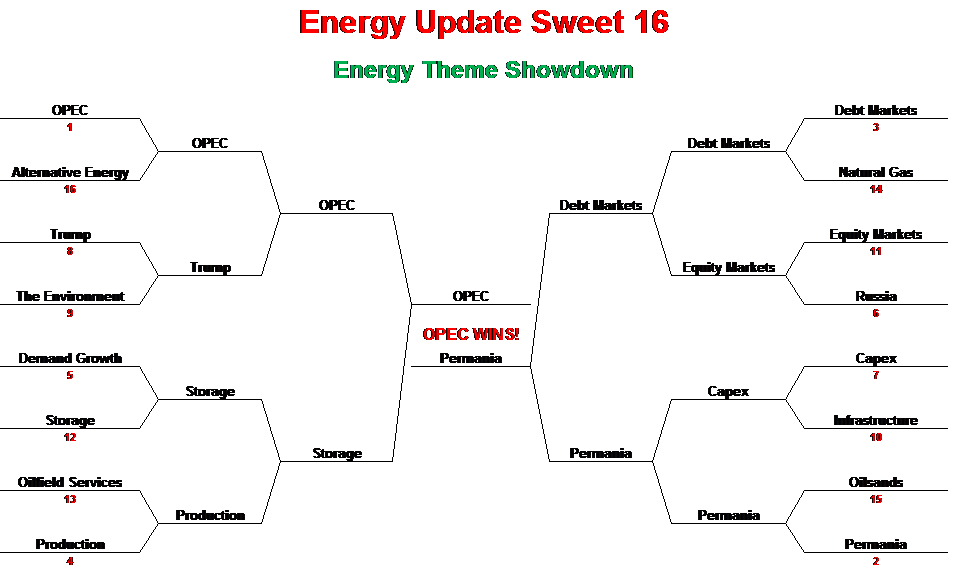

I am channeling my inner Verne Lundquist here as I prepare to submit my bracket for the second annual energy sector sweet sixteen, prepared in metaphorical fashion as we seek to make sense of all the nuances of the market and try to pick a winner.

As some of you may recall, last year it was Demand that won out over supply/storage to take the championship, which of course shows that I was pretty lousy at picking winners in this particular sweet sixteen. And by the way, it’s OK if you don’t remember last year, because I had to look it up.

At any rate, I had that supply/demand face-off in the final wherein I completely failed to pick either the right match-up or the ultimate winner having handily eliminated OPEC in an earlier round.

In all fairness, I totally blew the basketball call as well picking Duke and Virginia to face-off when it was actually Villanova over North Carolina.

That said, I am nothing if not a gambler/sucker for punishment so I am going to lay out the energy story as well as pick the final four and ultimate matchup and winner for this year’s actual tournament.

First, this year’s players are a little different than last year as the early rounds saw a lot of pretenders get eliminated including former major influencers such as Iran, China demand and the oilsands, while new powers such as Permania and Russia exerted some influence to muscle their way into the tourney.

So without further ado, the major themes face off against each other in an epic battle for global influence. First the match by match breakdown, then the braket.

Sweet Sixteen

In the first game, perennial favourite and number one seed OPEC faced off against number 16 seed Alternative Energy. While there was considerable hype before the game about the emerging power of the lower seed, and they did score a few points, they quickly ran out of energy and were ultimately blown off the court by the teamwork and coordination of the top-ranked team.

In an odd bit of seeding, we have a match up between the latest over-hyped one and done team Permania and former tournament darling Oilsands. Oilsands, with its slow motion, ball control offense was unable to mount much of a contest against the fast moving, flashy and high-flying tempo of the Permania team which has been firing on all cylinders for a while. Humbled by the loss, Oilsands fired all its international coaches and says it will concentrate on home-grown talent to be more competitive next year.

Debt Markets, the number 3 seed, made short work of Natural Gas which seems to have lost a bit of momentum after a very strong 2016. Maybe next year!

Oilfield Services was in tough against the emerging power of Production. The depleted services side wasn’t helped by the fact that half their players were released at the end of last season and have either yet to find their way back or are demanding better terms.

Moving down the bracket the potential for upsets becomes much stronger and none more so than the 11th seeded Equity Market runaway victory against 6th seeded Russia. Although in retrospect, we shouldn’t be surprised given how strong equity markets have been all year and the very real possibility that Russia gets its high ranking on the back of past glory. The bear may be big, but’s teeth are no longer that sharp.

Last year’s Cinderella story, 10th ranked Infrastructure didn’t pull off the upset this year and was thoroughly dominated by Capex which is a much bigger recovery story this year, even with Keystone XL coming off the bench in the second half.

However, the upset of the day went to a Storage team that just refused to go away against an early season favourite in 5th ranked Demand. Using a smothering defence that got stronger as the game went on, the Storage team over-powered the Demand side which seemed to shrink as the game went on while storage just got bigger and bigger.

The last matchup was certainly the most intriguing, pitting number 8 ranked Trump against the Environment, which was ranked 9th. While the FAKE NEWS was billing this as a blowout for the team in Orange, the Green squad put up quite a spirited fight. Ultimately undermanned, it was also soon revealed that the Environment’s leading scorer was actually a Trump transfer and plant so the squad was undone from inside through illegal scoring. Asked afterward to share their lineups and scholarship information, the Trump team pantsed the Green coach and asked them how long they have had a camera in the Trump locker room. Final score was Environment 66 and Trump 63. Which of course meant that Trump won.

Elite Eight

A number of intriguing matchups in this round.

In what was billed as a YUGE matchup between OPEC and Trump, it wasn’t even close, as the feisty American wasn’t able to execute his game of diversion and head fakes against a disciplined OPEC side. The dream match up of Rex (Sexy Rexy) Tillerson down on the blocks against Iran never happened as OPEC demonstrated uncharacteristic teamwork in dispatching the Trump side.

In another highly anticipated matchup, Cinderella-story Storage went up against Production. Both of these teams are from the same conference and recruit from the same area, but ultimately Storage proved a much more persistent team and seemed determined to stick around.

On the other side of the bracket, another same conference showdown pitted Debt against Equity. Billed as a battle of equals, Debt ultimately prevailed when it was revealed that they controlled not only the game, but also equity’s uniforms, equipment, arenas, transportation and, more than likely, firstborn. Tied at 52 early in the first half, Debt called their marker, packed everything up and advanced to the next round. For tracking purposes, the score was revised to 52-zip. It is expected that equity may return next year, if Debt lets them.

In the final match, Permania faced off against Capex. This was a fun game with each team feeding off of each other’s performance, scoring at will. Unfortunately, as the game wore on, the Permania team had more and more players on the floor such that by the end, it was impossible for Capex to get anything done without the presence of Permania. Finally giving up, Capex just changed uniforms and the refs called the game.

Final Four

In the opening game, Permania found itself matched up against Debt. This was an interesting matchup, showcasing hype versus slow, steady and boring. Debt tried everything it could to control the game, using four corners, milking the shoot clock and trying to control tempo but Permania would not be stopped, unleashing a scoring barrage and was almost mythical in its three-pointer efficiency. In the end, it wasn’t close with the Debt team ultimately throwing in the towel. Interviewed after the game, Debt’s coach said there was no controlling Permiana – they simply could not be stopped.

In the second match, top seeded OPEC took on tournament upstart Storage, but it quickly became apparent that as it wanted to, OPEC basically controlled Storage and like a cat played with it at will until ultimately overwhelming it and moving on to an epic confrontation with Permania, which is what we all wanted anyway.

Championship

OPEC vs Permania. The Big Enchilada. Well in this match, Permania raced out to an early lead and for a while it seemed that OPEC couldn’t handle the shale players speed but, eventually, as the second half wore on, the shale boys started to get ground down by the sheer size of the OPEC players as well as their numbers. The writing was on the wall when the cheerleaders suddenly switched sides. Ultimately, the game was nowhere as close as everyone thought it would be. OEPC wins. Again. Was it ever really in doubt?

So there you have it – agree or disagree, it’s hard to argue that the metaphor got taken behind the proverbial woodshed and beaten to death.

Oh yeah, Final 4 – Duke v Arizona and Kansas v UCLA. UCLA over Duke. Done like dinner.

Prices as at March 17, 2017 (March 10, 2017)

- The price of oil took it on the chin during the week ending down sharply as the market let US shale producers know exactly what they thought of them.

- Storage posted a surprise decrease

- Production was up marginally

- The rig count in the US continues to grow, although at a slower pace

- Natural gas was weak during the week on milder weather but rallied toward the end of the week

- WTI Crude: $48.78 ($48.49)

- Nymex Gas: $2.948 ($3.008)

- US/Canadian Dollar: $0.7507 ($ 0.7430)

Highlights

- As at March 10, 2017, US crude oil supplies were at 528.2 million barrels, a decrease of 0.2 million barrels from the previous week and 36.0 million barrels ahead of last year. High import volumes and refinery turnarounds are holding back meaningful invetory reduction. Inventory draws typically begin this time of year

- The number of days oil supply in storage was 34.1, ahead of last year’s 33.0.

- Production was up for the week by 21,000 barrels a day at 9.109 million barrels per day. Production last year at the same time was 9.068 million barrels per day. The change in production this week came from a small increase in Alaska deliveries and increased Lower 48 production.

- Imports fell from 8.150 million barrels a day to 7.405, compared to 7.693 million barrels per day last year.

- Refinery inputs were down during the week at 15.472 million barrels a day

- As at March 10, 2017, US natural gas in storage was 2.242 billion cubic feet (Bcf), which is 21% above the 5-year average and about 10% less than last year’s level, following an implied net wiothdrawal of 53 Bcf during the report week.

- Overall U.S. natural gas consumption was up by 15% during the week on increased weather related demand increases across all sectors

- Production for the week was flat and imports from Canada rose by 15% from the week before

- As of March 13, the Canadian rig count was 233 (36% utilization), 154 Alberta (35%), 31 BC (44%), 46 Saskatchewan (40%), 2 Manitoba (13%)). Utilization for the same period last year was about 26%.

- US Onshore Oil rig count at March 17 was at 631, up 14 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was up 6 at 157.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was down 1 at 19

- Offshore rig count at January 1, 2015 was 55

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 56%/44%

Drillbits

- Alberta Budget 2017 – more of the same. Infrastructure spending, pandering to special interests, increased taxes (carbon sales tax), no program spending discipline, hoped for firther recovery in oil prices. Did you expect any different? What’s $10 billion between friends

- On the subject of budgets, we have one coming federally next week. If the rumours are to believed, it may be one of the more unfriednly budgets for small businesses in recent (or long) memory with professional corps, small business tax rates and lifetime capital gains exemptions all in the cross-hairs. Against the backdrop of future personal and business tax rate cuts to come in the United States, one has to wonder if the legalization of marijuana has already been enactied for Finance staffers.

- Trump Watch: Trump submitted the White House budget document to the House this week. It’s big and complicated but in a nutshell, unless you are in the defence industry or border security, you should probably consider adding the word Permian to your program or department name and raise money in the public market because the axe is falling. Then on Friday, Trump wouldn’t shake hands with the German Chancellor Angela Merkel. Oh to have been a fly on the wall for their private meeting…