I was actually going to take a wee break from my blog this week after last week’s epic meltdown about my thoroughly inadequate first quarter report card on my Fearless Forecast and I was doing a good job about not stewing and tormenting myself about the world at large, the people in it who purport to control our lives or the monolithic governing institutions who wreck everything just because.

And then wouldn’t you know it? As they are wont to do, along came the Trudeau(p) LPC minority government with a big swinging debt-ridden, subsidy tossing, interest rate exploding, deficit accelerating, shameless vote-pandering, NDP cuddling, economy wrecking big government budget.

That’s right, as they have done for every budget so far in their run of incompetence and terror, the Liberal government has seen fit to throw as much money and jargon as they can at the proverbial wall in the hopes that the average Canadian remains duped by their feel good, sunny ways, social justice warrior smoke and mirrors budgetary shell game that purports to help raise up the poor paupers of Canada’s home-seeking masses as well as the middle-class and those seeking to join it.

Of coursed their budget achieves none of those things unless some set of overly optimistic assumptions comes to pass, including reductions in interest rates at a faster pace than any semi-competent economist forecasting, a rapid draw down in inflation and, of course, the continuation of elevated oil and gas prices to pay for most of it.

Instead their budget is a mish mash of “investments”, loans, subsidies and transfers to anyone, anywhere who might conceivably vote Liberal including seniors, young people wanting to buy a home, women who can’t afford contraception, first nations groups looking to develop AI, AI looking to develop first nations, entrepreneurs looking to get a leg up in 5 years by starting a business in a Liberal approved industry, means tested people wanting to go for free to the one dentist who signed up for the dental care program, battery tech developers, foreign companies pretending to want to manufacture batteries here, anyone willing to buy a p-o-s Cybertruck, clean energy consultants and grifters, the occasional real company that does clean energy installations, renters, homeowners, municipalities willing to sell out their citizens for a little sewer construction lucre, old people who are underhoused and need dental care, insulin, contraception while living on a reserve developing battery tech to power AI while riding a high speed train to their social housing and rent-controlled tiny home for struggling young people on a single family lot in Vaughan – I could go on forever! But I won’t.

And you know what? Somewhere inside of the culmination of this nine year tsunami of spending, debt and deficit growth, some voice of reason (most likely since fired) piped up and asked if there was a plan to, you know, pay for all of this “stuff”.

Sure there was – once the banks and other buyers of government debt have had their fill of shakily AAA rated Canadian government deficit-plugging debt, the government indicated it was going to go back to yet another time-honoured vote-buying tradition.

You go it.

Soak the rich and fatcat corporations!

But how to do it this time. There are already surtaxes and clawbacks and luxury asset purchase taxes on a personal level. And the excess profits train has already left the station for banks and the telcos own the government. Could taxes be raised on oil and gas companies – sure, but they are already carrying most of the federal tax weight in Canada.

Nah. It’s time for something obscure. Something that is a big shiny bauble just waiting for the government to latch onto and sufficiently confusing and arcane to Jacques and Jeanne Q Canuck that assailing it will of necessity be an exercise in excruciating boredom, requiring people to run to the tax code and put everyone to sleep.

Plus it needs to be innocent sounding.

And so we have the evil genius of “raising the inclusion rate for capital gains on individuals and firms from 50% to 66%.”

Seems innocent enough right?

Unless you work in the world of investment, capital formation, start-ups, M&A, entrepreneurship, SME’s, private and public equity, estate and tax planning, banking, starting/growing/buying/selling of businesses, or anything remotely related to that.

If that’s you – your head likely exploded.

So, what happened?

A wee increase in an inclusion rate. Well, it sounds innocent. It’s not.

The inclusion rate is the percent of capital gains on the sale of “something” that needs to be added to your income and be taxed. The proposal is to raise this inclusion from 50% to 66%.

What this basically means is that if you had $100 in capital gains, $50 would have been taxable. Going forward, that will be $67. More on that later.

This is the first change to the inclusion rate since the year 2000.

Yes, I know the inclusion rate has been all over the place. From a low of zero prior to 1972 (when capital gains weren’t even taxed!) the rate has been 50%, 66 2/3%, 75%, 66 2/3% again and then in 2000 it hit 50%. It should be noted that the significant raises in the inclusion rate prior to now happened under Conservative governments, however the caveat is that they were faced with crushing recessions and the need to finance record deficits. In the current environment, we aren’t raising the inclusion rate to help dig us out of a deep recession caused by global events. No, we are instead using this tax increase to finance an election budget filled with all the vote-buying goodies described above.

So what does it mean?

Well, first of all, the rule of thumb for capital gains is that at the full tax rate and 50% inclusion the tax rate payable on capital gains is about 25%.

The change to the inclusion rate moves that tax rate to 33%. This is like an 8% increase to the top marginal tax rate.

Taken another way, that’s a 33% increase in your capital gain tax bill. A $3000 tax owing is now $4000. Ouch.

Of course the Liberals know that this won’t play well with the investing crowd. They are really after the fatcats after all.

So, they have some qualifiers, to ensure they don’t lose votes of course.

The first is that they have introduced a concept that the first $250,000 of capital gains a year is at the 50% inclusion rate, then it goes up.

Also, they have increased the Lifetime Capital Gains Exemption that applied to owners of Canadian Controlled Private Corporations who sold their businesses from $1 million to $1.25 million.

Lastly, they have created what they call the Canadian Entrepreneur Incentive, which provides for an additional $2 million in Capital Gains Exemptions for founders of Canadian businesses (going forward) who meet a very narrow, and presumably Liberal industry friendly, set of criteria.

Hmm. OK, I guess.

But it’s still a 33% increase in the tax payable on the non-exempt portion of a capital gain.

So it’s still a tax grab.

Yeah, but it’s all on the super rich people! The robber barons of the grocery world, the fat cat bankers. Justin Trudeau says it will only impact 0.13% of taxpayers! Right?

Nope.

Sure, those demographics will get captured here, to the extent they trade and to the extent that their assets aren’t already otherwise sheltered inside some trust fund or offshore tax haven.

But the real impact here is going to be in the great business bulge. The hundreds of thousands of SMEs (Small Medium Enterprises) that comprise a consequential portion of the economy who at some point are going to want to sell their business (as a side note, hopefully engaging advisory assistance 😊) and are suddenly seeing their expected after-tax proceeds eroded. Not to mention the boot-strapped fruits of their labour cynically disrespected by spurious tax increase while at the same time their government pillories them as fat cats not paying their fair share.

It is sounds like I am mad, it’s because I am. And I am highly concerned at how this change is going to impact the world of private business and capital formation.

Where on April 15, we had a historically stable and predictable capital gains regime that was competitive with the Unted States we will soon have one that is in flux and now a political wedge issue.

Implemented by a minority government that has overseen a precipitous drop in Canadian productivity and investment propped up by an opportunistic left-wing partner that is by constitution hostile to capital, profits, private investment and making a buck (unless you are the leader).

In one fell swoop, the government has made it less exciting to start a business, more expensive to sell a business, raised the cost of capital for private transactions and sent a shudder through the private economy.

Look, I know that there are esteemed economists who I have the utmost respect for who have shown that this new structure simply accomplishes an elegant convergence between all sources of income so that intellectually it makes sense, at some level, as long as we conveniently ignore that we are trying to achieve this convergence with personal income tax rates that are offensively high. And therefore they think this is “fair”.

I don’t agree and I think it’s because I live in the real world where risk is a thing and there are trade-offs and sacrifices made by people who start and invest in businesses as opposed to the dividend collecting passive investor or the paycheque casher. The risk profile is different.

People who defer their payday investing in private illiquid businesses are not the same as someone collecting a paycheque, or an investor clipping dividends or even Galen Weston day trading Loblaw’s shares to generate gains.

And if you have a sputtering economy that Canadians and the Liberals are currently faced with, you want to present every opportunity for this private entrepreneurial class to do their thing. Hanging out the sign saying “open for business, it just costs more” isn’t as appealing as it seems on the surface.

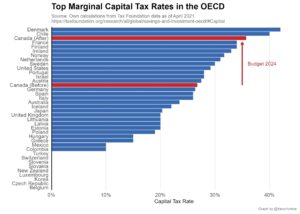

In one fell swoop, the government has made Canada among the least competitive countries in the developed world for capital gains treatment. Don’t believe me? Here’s a handy chart that shows us where we used to live (in the median) and where we will now reside – up there with economic powerhouses and investment juggernauts Denmark and Chile. Not to pick on those countries, they are fine places, but if we want to be competitive and keep our investment dollars at work here, shouldn’t we at least try and stay even with or below the United States?

Changing the dynamics here changes their decision making and appetite for risk. After all, if you are going to pay the same tax rate on all sources of income anyway, wouldn’t human nature suggest people will just forego risk and take for the sure thing? We can’t all work for the government, can we?

Don’t even get me started on the “pension shakedown” that the government is engaged in where they are trying to get pension funds to reallocate capital back to (uncompetitive) Canada to reinvigorate the investment and productivity. You know what an interesting thing about pension funds is? They don’t pay capital gains taxes. So, while making it less attractive for entrepreneurs to own their own businesses, the government is also working to facilitate more institutional ownership of the economy and reducing their own ultimate return from potential value creation.

Like, make up your mind guys…

Look – my business is primarily the sale of private mid-market businesses so I will be the first to acknowledge my bias here.

But this change is a veritable kick in the “teeth” to the thousands of silent business owners who often have their entire net worth tied up in these highly illiquid, risky investments, being responsible for and employing millions of Canadians and who had counted on the stability of the taxation regime to exit their business at some point with a certain tax outcome and move on with their lives.

Did the federal government give proper consideration to these knock-on effects when they developed this change going after the “0.13%” or, was this the intent all along to cash in on the oncoming transition of businesses from the retiring baby boomers to fund all their pet projects and disguise it as “tax fairness”.

We will never know.

What we do know is that this is just another example of how this liberal government targets specific sectors of the economy in order to deflect blame and avoid responsibility for its policy disasters to curry favour with voters.

Whether it’s the satans of the oil and gas sector, the grubby ink stained wretches at banks, the robber barons at grocery stores, greedy developers or fat cat Richie riches cashing capital gains cheques at the expense of the downtrodden it’s their fault, not the governments and it’s nothing more than an cynical ploy to buy votes.

And it’s wrong.

And I hope Canadians see through the sunshine and rainbows and hold them to account.