Well folks, since last week was a review of referendum questions including that whopper that happened in 1980 in Quebec that I had to live through as a spry 15 year old budding political activist (not even remotely true BTW) and the Habs are in the Stanley Cup semi-finals, it is only appropriate that I continue this trip down memory lane.

Of course I do this every year at this time, mostly because I’m lazy and I tend to do affair amount of blog repetition, but also because summer is coming and it is, in fact, time to slow down a little bit. And I have decided, in the interests of my sanity and as a precursor to ginning up more topics, that I will be taking the blog to bi-weekly status after my traditional mid-year series of blogs – notably the Canada Day celebration of all things Canuck, the Q2/Mid-Year review of my Fearless ForecastTM and the shameless cry for attention that is my self-celebratory birthday blog.

Last year of course was Freedom 55, which as anyone who works in the energy industry knows is an absolute pile of horse-hockey. Because as we all know, the energy industry, the official worst industry on the planet, is an environment and fortune-killing spewer of carbon evil, mere steps away from taking the planet down for the count, never to recover.

OK, not really. The energy industry has been just fine to me and my family. Which of course is why we rebranded last year. Actually, that’s not true either. We rebranded so we would stop confusing clients.

And the energy industry, writ large to include all forms of energy (because it should), is actually doing pretty well right now. Prices are up, demand is recovering, supply is tightening, energy anxiety is increasing. These are all the building blocks we need to get some attention paid to what is, let’s face it, one of the more important industries on the planet, a key to our long term survival as a species and the backbone of our way of life.

But I am getting ahead of myself. I’m not here to talk about energy. Well not exactly.

And I’m not going to talk about referendum questions this week, or sham senate elections or Sky Palaces or sit-down Italian meals that may or may not have been allowed or the demise/implosion of the Green Party or whether Trudeau should have stayed in a prescribed hotel in Toronto when he came back from the G7 – note: he shouldn’t, he’s the head of state, why are we even asking stupid questions like this? Hockey players aren’t even doing it now. Stop doing the conserve-populist reverse virtue-signalling and grandstanding on a fake principle that we know you won’t follow.

As I get older (and I do get older every day), I become more cynical and jaded about politics and, fortunately, thus more capable of drowning it all out.

Looking back to this time last year, when I officially joined the Freedom 55 cohort and thought that the pandemic was over (how’d that work out?) I was giddy at the prospect of all the goodies and super-cool seniors benefits and discounts that I was suddenly qualified for such as 20% off at Golden Griddle (excludes alcohol); 20% off at Shoppers and 20% off at Value Village.

Not to mention the best senior’s discount. The ability to put 20% less effort into the blog anytime I want, freeing up time to tell people to get off my lawn.

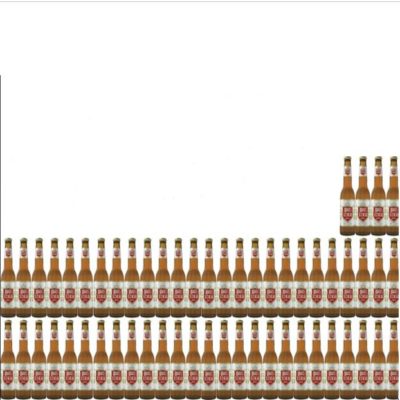

At any rate, true to tradition, each year I throw together a lazy list of energy and/or random thoughts. This year there are 56 of them because I am turning 56 on Monday. My daughters think I am super-old. And they may be right, but you only feel old thinking about actually relevant and important referendums and Canadian teams winning Stanley Cups. It’s been that long.

At any rate, before I “retire” for the day and start my long weekend… Here are 56 pithy, insightful and random observations – primarily about the oil and gas sector.

- Just like last year, we are depending on OPEC+ to help us out with the price of oil. Where last year we were flirting with $40 and economic catastrophe from demand destruction, pandemics, this year we are dealing with $70 oil, looming supply issues and gathering inflationary pressures.

- The natural gas industry in Canada has actually been a beacon of stability now for two years. Go figure.

- The Saudis have run OPEC+ like the true masters of the oil industry they are. After successfully throttling the US shale industry, the KSA has overseen the longest period of OPEC+ solidarity ever seen and successfully deflated the oil inventory bubble that threatened the industry. And made a bazillion dollars in the process. Well played.

- North America has more than 3 million miles of oil and gas pipelines, split roughly 80/20 between the United States and Canada. 1800 miles KXL will never be part of this.

- Since I was born in 1965, there have now been 4 major oil price shocks including exactly one day when prices were negative. Each time the market recovered. Go figure.

- I am older than OPEC

- Having achieved Freedom 55, I am reminded that my youngest daughter’s teacher played an investment advisor in one of the classic Freedom 55 ads. I guess I could have learned a thing or two from that ad.

- In 1965, the American’s closest ally in the Middle East was Iran

- The first real frac job ever recorded was in 1865 (100 years before I was born!) in Titusville Pennsylvania when Civil War veteran Col. Edward A.L. Roberts lowered a torpedo into an oil well, covered it with water and detonated it, vastly improving the well’s yield.

- The first commercial hydraulic frac was in 1950.

- Since that time, frac’ing has significantly improved, but the process is still the same – jam something under massive pressure into a well until the rock fractures and the molecules/liquid flow to the surface. Biggest difference between now and then? Efficiency. And safety. I guess we can’t forget that. Boom.

- The longest horizontal frac on record is about 18,500 ft, drilled in the Utica Shale, which is a natural gas play. Total depth was about 27,000 ft. So 1.5 miles down and 3.5 miles horizontally. 124 frac stages.

- The largest frac job ever utilized close to 50 million pounds of sand or proppant in a Haynesville shale well in Louisiana. The lateral length of the well was about 10,000 ft. As a point of reference, the Eiffel Tower weighs 14 million pounds and is just under 1,000 ft tall.

- “Frac hits”, a phenomenon where laterally drilled wells start to run into vertical and horizontal wells belonging to other operators continue to plague large scale drilling operations in the United States. This is leading to much legal work. Seriously folks – 5 miles of drilling in multiple directions from a multiwell pad and held open by 3 and a half Eiffel Towers worth of drill pipe, sand and water – is anyone really surprised companies are running into each other?

- Canada has the 3rd largest reserves of oil in the world and the 10th largest reserves of natural gas

- Canada is the only country in the world that has only one customer for its largest export

- The energy sector, broadly speaking, represents between 10% and 15% of Canadian GDP.

- Put another way, 15% of our national wealth depends on the exploitation of these reserves, our 500,000 miles of pipeline and the goodwill of one country

- In 2019, Canada was recognized as having one of the most stringently regulated oil and gas industries in the world. The jury is still out on 2021.

- It is estimated that in Russia the equivalent of 50,000 bpd of oil is spilled annually (5% of production). That would be like half of the production of the massive Surmont SAGD facility in Fort Mac being dumped into the Athabasca River every day!

- Venezuela is an environmental and societal basket case, has the largest reserves in the world and has seen production collapse from 3.5 mm boepd to less than 0.5 mm and now requires black market refined fuel imports from Iran.

- The environmental degradation of Venezuelan oilfields and facilities from lack of investment and little to no regulation is likely to never be cleaned up… I repeat, never. Ever. You can light Lake Maracaibo on fire. But hey, Canada is the bad guy. https://www.caracaschronicles.com/2020/11/25/swimming-and-fishing-in-a-sea-of-oil/ https://www.caracaschronicles.com/2020/10/20/venezuela-is-on-the-brink-of-its-worst-oil-spill/ https://www.caracaschronicles.com/2019/09/07/how-oil-killed-lake-maracaibo/

- Global spend in the oil and gas sector averages about $2 trillion a year, about $200 billion more than Canada’s annual GDP. Of that, about $600 billion is typically spent on exploration and new production

- Global E&P capex in oil and gas is expected to be flat at $400 billion in 2021 as we emerge from the COViD induced slowdown.

- In Canada, capital spending in the oil and gas sector is expected to increase to more than $30 billion this year, a welcome relief from last year, when at $24 billion it was less than the estimated capex for renewables. For the first time ever.

- Of the $11 billion spent on environmental protection in 2012 (last year data available, gotta love government), 43% was spent by the oil and gas industry. The next closest industry spent 12%

- Total spending on tangible environmental protection by Canada’s environmental lobby groups since I was born in 1965 has been about $0

- The first politician whose name I ever heard and recognized at age 3 was named Trudeau. Now, a mere 53 years later, it’s the same damn name in charge, except he has more hair. Go figure.

- Western alienation is a big deal that I didn’t understand when I was 3. Oddly enough, this guy got it https://www.cbc.ca/archives/entry/trudeau-not-worried-about-western-alienation

- The oil and gas sector is one of the largest employers of First Nations people in Canada.

- Suncor employs more First Nations people than the Federal Government

- In 1965, global consumption of oil was just over 30 million barrels of oil a day. In 2019 it was about 100 million barrels a day. In 2020, it fell to about 94 mm bpd. It took a pandemic and global economic shutdown to stop this growth. In 2021, consumption will close the year at 97 mm bpd, before resuming it’s 1% a year growth for… who knows how long. I sure don’t, so don’t believe anyone who says they do.

- In 1965, North America produced about 10.9 million bpd (32% of global production of 34.5mm bpd) and in 2021 that number is expected to be about 17 million (23%)

- In 1965, the Middle East produced about 9.4 million bpd (27%) and in 2021 that number was about 22 (25%). Total all-in OPEC production is currently about 34% of total global production

- There are currently more than 300 million vehicles in the United States. At current rates of production, it will take about 100 years to replace all of them with electric vehicles.

- Alternatively, annual vehicle sales in the US are about 17 million. If all vehicles sold from this day forward were EV’s, it would take about 60 years to replace the fleet. And you’d still likely have about 150 million gas powered vehicles on the road. People like to have 2 vehicles.

- In the early 2000’s, total fossil fuels’ share of the energy market was about 85%. Since then, hundreds of billions of dollars have been invested in renewables such that fossil fuels current share of the energy mix is… Yup, you guessed it, 85%.

- Pre-COVID, no country was on track to meet their Paris Accord emissions targets, except France. And maybe the US, which has seen major reductions in emissions, ironically thanks to accelerating gas production edging out coal for power. Ironically, the whole pitch behind exporting Canadian LNG to Asia

- Post COVID, no country is on track to meet its Paris Accord emissions targets. Except maybe France and the US.

- 40% of the world’s ocean cargo is oil

- It took more than 100 years and trillions of dollars to build out our current fossil fuel-based infrastructure

- There are more than 1.75 million active oil and gas wells in the United States.

- There are more 225,000 active oil and gas wells in Canada

- In the United States it is estimated that the oil and gas industry supports around 10 million jobs or 5% of the labour force. Of this, close to 800,000 are directly employed in the services sector

- The US oil and gas services workforce is among the hardest hit by COVID in the world, with at least 100,000 jobs lost

- In Canada, the similar employment number is 250,000 direct oil and gas jobs and probably another 300,000 indirect jobs, with COVID related job loss likely in the range of 50,000.

- In 2019, the US drilled some 22,000 and completed about 10,000 wells. In 2020, the US drilled less than half that. In 2021, the number of wells drilled is expected to increase by about 15%.

- In 2019, in Canada, about 5,000 wells were drilled and/or completed. Activity fell by 50% in 2020 but is expected to recover by at least 30% in 2021.

- On this date in 2019 there were 789 rigs drilling for LTO in the United States. Today there are 373

- Joe Biden has dropped as much of a hammer as he can on the US energy industry. Aside from KXL being cancelled, Joe is bullish for Canadian production. Even if the media doesn’t pick up on this.

- Saudi Arabia still decides where the energy industry is going to go. Which makes it reassuring that they have picked up some heavy oil shares

- Only half of a barrel of oil is used for gasoline, the rest is used in more than 6,000 common products including hand lotion, football helmets, insecticides, fertilizer and fidget spinners

- The countries with the highest use of energy per capita also have the highest life expectancy, demonstrating that access to cheap and plentiful energy is critical to increasing life expectancy and pulling people out of poverty

- The energy industry is one of the most important industries in the world and touches virtually all aspects of our lives, every day, so maligning the energy industry and blocking projects is hypocritical and denies the reality on the ground that our privileged lifestyle depends on a healthy energy economy

- Notwithstanding Coronavirus, in 2020/2021 the private and public sector in Canada will likely be involved in the construction of close to $75 billion in energy infrastructure including thousands of kilometres of oil and gas pipeline and massive investments in LNG and petchem processing facilities. Not bad for a country mired in regulatory gridlock, in the midst of a pandemic, a sector facing an existential crisis, demand destruction, high debt loads and, let’s face it, an indifferent population. Imagine what we could do if we cared!

- This is the (hopefully) backside of my fourth energy cycle as an industry participant. It’s a soul-crushing grind but it also makes you eternally optimistic. I truly believe the future is bright for Canadian energy in all its forms and am proud to play my part in helping it grow. Regardless of whether we are Stormont Capital or Stormont Energy, the companies and people who produce the energy, service it, deliver it, maintain it and clean it up when it’s been used remain our key constituency and we are committed to being part of their team for the foreseeable future, or as I like to call it – Freedom 95 (ugh 39 more years of blogs – what have I gotten myself into?).