So what happens is you throw an election party, everyone votes and you still can’t tell who won? I’ll tell you what – migraines for the energy sector, courtesy of Canada’s leftmost, oddball province.

I’m talking of course about the BC provincial election held last Tuesday.

As of this writing, the incumbent BC Liberals were elected in 43 seats, the NDP in 41 and the upstart Green Party in 3. This leaves the Liberals one seat short of a majority and the Green Party holding the balance of power in the provincial. Or maybe not. Because apparently BC doesn’t count their absentee ballots until two weeks after the election, and there are a lot of them. And there are a lot of close races.

So now literally everyone with a stake in the eventual outcome is walking on eggshells and trying not offend each other, cozying up and talking nice for the media. But that could all change next week, or not. Who knows. How ridiculous.

Here’s what we do know. Sort of.

Christy Clark will either be invited to lead a minority government (failing that it would fall to the NDP to try and form one) or she will be handed a slim majority when the count is done, or neither party earns the confidence of the legislature and there will be another election.

In a slim majority, it’s pretty simple. Projects can move forward, likely in the face of exceptionally loud and emboldened protest, but the provincial government stays out of the way, by and large. But with only a slim majority, the Liberals can’t afford one slip-up in the legislature and party unity will be paramount.

In a minority situation, no matter who is the lead party in the minority (my money is on the Liberal party) the Green Party will hold sway out of all proportion to their popular vote and seat count (not even official party status!) and the prospects for the smooth development of infrastructure projects such as the Trans Mountain Expansion or Pacific Northwest LNG (assuming Petronas doesn’t just leave BC altogether) are cratered.

The provincial NDP is against TransMountain but needs LNG to pay for their unfunded spending wish list. Green Party leader Andrew Weaver is anti-fossil fuel and anti-fracking, so the real question is what concessions the Greens will seek on the energy front in order to provide support to the Liberals or the NDP on other issues they may agree on. While the approvals granted for the pipeline expansion and LNG project are federal and legally there is nothing the province can do, it will test Federal Liberal mettle to no end to force them through in the face of entrenched opposition. And, not that I’m giving the Greens their strategy, what is the use of an LNG plant if, for example, royalties on gas were raised or new fracking rules were imposed that raised the cost of natural gas extraction in Northeastern BC just enough that the economics of an LNG plant break down. Just saying. Under that scenario, the prospects for resource extraction and the prosperity of Northeast BC, will take it in the chin.

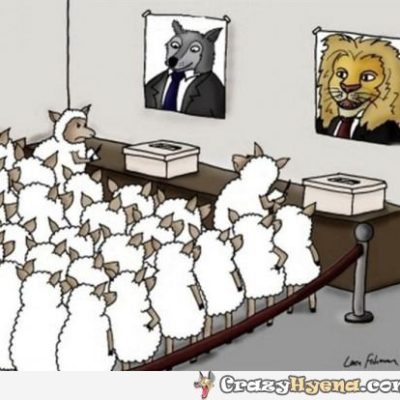

Once again, an electorate demonstrates its unique ability to vote against its own economic self-interest. Fascinating.

But at least we can all sit in our comfy little cocoon of plenty and smugly pat ourselves on the back that we are doing the right thing and continue on with our sheltered and mostly uninformed lives oblivious to the world around us.

And the reason I bring that up is that quite often we get so myopic about our local issues that we are blind to tragedies unfolding around the world, often until it is too late.

I mention this, and it’s a pretty aggressive pivot from the BC election, because what is currently unfolding in Venezuela is a tragedy of unbelievable proportion that seems to be under-reported, certainly in Canada while the US seems to finally be cluing in. Admit it, you didn’t think I was going to South America, but it’s a disaster decades in the making and it appears to have reached a point of no return.

While we spend a lot of time looking to conflicts in the Middle East or worrying about sabre rattling in North Korea or trade with China or what the Donald is going to do next, the failure of Venezuela has the potential to be as, if not more, destabilizing to our region as any of these.

The reason for this is because despite being blessed (cursed?) with the largest reserves of oil in the world, Venezuela, which was once the wealthiest country in South America, is on its way to a becoming a failed state.

Don’t believe me? Consider the following.

- Depending on whose stats you use, GDP shrank by about 10% in 2015, 20% in 2016 and is currently expected to contract by at least 7% this year.

- Inflation in 2016 was 800% and some estimates suggest it will run at a staggering 2000% in 2017, suggesting the very real prospect of hyper-inflation. The value of the currency on the black market has dropped by more than 99%. The country can no longer afford to import the goods it needs.

- Foreign reserves are estimated to be only about $10 billion

- Foreign debt is estimated to be about $140 billion including debt issued by PDVSA, the National Oil Company.

- Oil production accounts for 90% of exports but, starved of capital investment because of government incompetence, production has declined to just over 2 million barrels per day from its pre-Chavez peak of 3.5 million. As the only source of foreign exchange to pay off the crushing debt and/or buy food and medicine for 31 million people, the NOC is really the only thing standing between marginal solvency and complete collapse and anarchy. It is, as I read somewhere, an oil company with a country attached.

- Once self-sufficient and a major exporter of food, Venezuela now imports more than 90% of its food requirements largely because government imposed price controls and subsidies (that it can no longer afford with the fall in oil prices) and nationalization of private business has discouraged production, not to mention rampant corruption and an official exchange rate disconnected from reality. Food shortages are everywhere and food rationing by government is being used as a way to control the population.

- The same situation exists in the health care sector, where even the most basic medical supplies are in short supply and people are dying from ailments so mundane they wouldn’t even warrant a doctor’s visit here in Canada.

- The individual and collective tales of human suffering are heart-breaking. Infant and maternal mortality were up a staggering 30% and 65% in the last year. Chronic malnourishment has led to the average citizen losing about 20 lbs in the last year and is expected to have knock-on effects on health of the general population for generations to come. If you have the stomach for it, I recommend you follow the Caracas Chronicles to get the on the ground perspective of the implosion of a country. https://www.caracaschronicles.com/

- The country’s main electricity provider can only supply power sporadically due to chronic mismanagement and a persistent drought.

- The country is among the most violent in the world and the capital, Caracas, is now the murder capital of the planet with a murder rate of 130 per 100,000.

- Daily and nightly protests for the past month have already claimed more than 30 lives, hundreds wounded and a thousand arrested… and counting.

- Government support is below 20% and opposition is broad-based and now includes those poor areas that would have been considered a lock for support of the ruling party. Nicholas Maduro, the “leader” of the ruling government has triggered a constitutional crisis and is proposing a constitutional congress that amounts to a coup if it goes through by consolidating power through his cronies and some (not all) of the military.

- And the government blames an international plot and the Americans for its problems. Yeah right.

And it is all so unnecessary and, sadly, might have been avoidable.

It is beyond me how the current government continues to cling to power while organizations such as the United Nations, the IMF, and others sit idly by. Only the OAS (Organization of American States) has put any pressure on the Maduro regime, mainly because they are direct neighbours. Meanwhile, Russia, China and Cuba provide tacit or momentary support to further their own self-interests.

Where are the Americans and what is their strategy to deal with this unfolding collapse of civil society, rule of law and, in theory, liberal democracy in their own backyard? Never mind the dominoes that will fall if Venezuela collapses, from China basically owning the country’s reserves to CITGO, a PDVSA refiner that owns some 30% of US-domiciled refining capacity falling to the hands of Rosneft, a Russian oil company that provided loans to PDVSA with CITGO equity as collateral. Is this really an outcome that is in the United States’ national security interests?

It is often said that if Syria had substantial reserves of oil that the world, led by the United States, would have intervened against Assad much sooner and prevented that crisis from escalating. Well, Venezuela has reserves and then some, and the time for the international community step up and pay attention is at hand. What’s the plan guys?

Prices as at May 12, 2017 (May 5, 2017)

- The price of oil rallied during the week on storage and a little bit of OPEC optimism.

- Storage posted a larger than expected decrease

- Production was up marginally

- The rig count in the US continues to grow, although at a slower pace

- Natural gas was up marginally during the week, avoiding most of the oily drama

- WTI Crude: $47.90 ($46.35)

- Nymex Gas: $3.413 ($3.268)

- US/Canadian Dollar: $0.7297 ($ 0.7324)

Highlights

- As at May 5, 2017, US crude oil supplies were at 522.5 million barrels, a decrease of 5.3 million barrels from the previous week and 14.0 million barrels ahead of last year.

- The number of days oil supply in storage was 30.7, behind last year’s 33.7.

- Production was up for the week by 21,000 barrels a day at 9.314 million barrels per day. Production last year at the same time was 8.802 million barrels per day. The change in production this week came from a small increase in Alaska deliveries and increased Lower 48 production.

- Imports fell from 8.264 million barrels a day to 7.620, compared to 7.655 million barrels per day last year.

- Refinery inputs were down slightly during the week at 16.759 million barrels a day

- As at May 5, 2017, US natural gas in storage was 2.301 billion cubic feet (Bcf), which is 14% above the 5-year average and about 14% less than last year’s level, following an implied net injection of 45 Bcf during the report week.

- Overall U.S. natural gas consumption was down by 1% during the week – a decrease in power demand offset increases in retail and commercial demand

- Production for the week was flat and imports from Canada rose by 5% from the week before due to pipeline maintenance

- As of May 8, the Canadian rig count was 80 (13% utilization), 66 Alberta (15%), 10 BC (14%), 4 Saskatchewan (3%), 0 Manitoba (0%)). Utilization for the same period last year was below 10%. With breakup now on, this count isn’t expected to rise significantly for the next month or so.

- US Onshore Oil rig count at May 12 was at 712, up 9 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was down 1 at 172.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was up 2 at 20

- Offshore rig count at January 1, 2015 was 55

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 56%/44%

Drillbits

- The US announced a deal to allow shipments of natural gas to China. Let that sink in. So after almost a decade of dithering about Canadian LNG and the inability to source markets for our natural gas or get infrastructure approved, along comes this, the Trump administration’s first negotiated trade agreement with China. I think the Federal Government needs to take note of this.

- Kinder Morgan Inc. is seeking to raise about C$1.75 billion in an initial public offering of assets including the Trans Mountain pipeline system in Canada. The company elected to go the IPO route instead of the joint venture route as it allows the company to retain a greater interest in the project.

- Capex in the US is expected to hit $84 billion in 2017, a 30% increase over the prior year with much of the focus in the Permian Basin. International capex is only expected to rise about 3%. Canada is expected to be somewhere in the middle.

- Trump Watch:

- In an interview with The Economist, the Donald claimed to have thought up the phrase “prime the pump”. Oy.

- You’re Fired! Donald Trump finally got to fire someone again, this time it was James Comey, Director of the FBI. Although he didn’t do it in person, he sent a letter. On the letter was a post-it note, I’ve seen a copy of it and this is what it said:

Ты уволен!!