Can you believe another quarter has come and gone? I mean seriously that was fast. It felt much more like a short 90 days. And it feels like the world has changed in those 12 weeks since I last looked at my forecast. So much happens in three months that it’s hard to stay on top of things. I mean yeah, I’m pretty sure I’ve been glued to Twitter for at least the last 2,160 hours which of course has helped me keep up with the news.

And there’s been a lot. Seriously. In the last 129,600 minutes we have seen a pipeline get purchased by a environmental virtue signalling, fossil fuel hating Canadian government, a US/North Korea summit and Bromance, the emergence of a global trade war, the ditching of the Iran Nuclear accord and imposition of new sanctions (US again BTW), the approval of Line 3, offtake problems explode in the Permian, and oil prices recover to levels not seen since late 2014. It’s truly astounding. And this was all done in a mere 7,776,000 seconds. Pretty impressive! What we haven’t seen of course is a sustainable recovery in Canada or LNG approvals but who would have predicted that? Me? Maybe.

Or maybe not. I don’t remember. It’s been fully half a year since I wrote those predictions – do you remember what you were forecasting 6 months ago? I mean, I can’t remember what I had for lunch half an hour ago, never mind some half-baked prediction 24 weeks old. That’s like 180 days – it’s a long time…

OK, OK. I’ll stop. Really what you’re seeing here is avoidance and fear. Fear of looking at my numbers. I don’t want to know how I’ve done. I’m not ready for it. We have an intern working for us this summer. He’s updated the numbers. So he’s in the loop as to how badly I may have whiffed. HE KNOWS! And every time I pass by his desk he avoids eye contact. So I can only guess how bad it is. I’ve finally been bested by events. The unpredictability of Trump, the lack of dynamism in natural gas, the resilience of the Permian story and the stupidity of the capital sources who continue to pump green dollars into ever-longer fracks – these all serve to undermine my most reasoned and knowledgeable takes on the future.

It’s gotta be bad. The intern just snuck out. He knows I’m about to open the file with the numbers. Here goes. Slowly. Oh my god… I can’t look… help… mother…

Broad Themes

One of the bigger themes I had on my radar at the end of last year was civil unrest, in particular in the Middle East and Saudi Arabia but also more broadly across the region.

So far Syria seems to playing along as are the Palestinian territories, but Iran and Saudi Arabia for a while seeme4d like they were keeping things in check, notwithstanding the various proxy confrontations and the escalation of the Yemen conflict. However, all bets came off when Trump announced he was withdrawing from the nuclear agreement with Iran and put in place stiff new sanctions on Iran. The effect of this is to destabilize the entire region. While it remains to be seen how stiffly sanctions will be enforced, there is little doubt whose “side” the US has chosen in the ongoing struggle for domination in the Middle East. Expect the proxy war in Yemen to heat up. Russia kind of backs Iran even while partnering with Saudi Arabia on OPEC. Other proxy conflicts in Lebanon and the Palestinian territories will continue to escalate notwithstanding the efforts of peace luminaries such as Jared Kushner. As the summer heats up expect tensions to fray. As this happens, reforms get ignored, civil liberties are curtailed and the squeeze gets put on younger populations at the economic margin which we are seeing as economic protests expand in Iran and Saudi Arabia continues to face down a massive youth unemployment problem – and we all know where that leads. Grade C – still evolving.

The other part of the unrest prediction was with respect to Venezuela. I have been harping on this for more than a year now and it finally appears that the rest of the world is beginning to take notice, at least insofar as the oil price is reflecting the collapse of the Venezuelan oil industry which will take decades to reverse. In the meantime, the population starves and the Maduro government clings to power in a desperate attempt to avoid jail or worse from the inevitable popular uprising. At some point the army will change sides and all bets will be off. It will at that time remain to be seen whether the country improves or not under switcheroo dictatorships but all things considered, it’s hard to imagine it being much worse. Much will depend on whether Russian, Chinese or American influences gain the upper hand. My money is on China – they have the most to lose given they have been propping up the country for some time and they want the oil. Grade C – can’t get full marks for stating the obvious, this is like 1 x 1 on a math test.

Technology. OK, so maybe I don’t really understand what it is but I did say that Blockchain was going to be an emerging force in the energy sector as the year progressed. If media blather is anything to go by, it’s already well away as scarcely a day goes by without some new breathless article about how technology and blockchain is changing the energy world. AI and data acquisition are the operative buzzwords with many clients in search of the holy grail of efficiency and it seems that he who owns the data may indeed win the day. Grade B – look, it’s happening.

On the energy front my forecast had an evolving story over the course of 2018 centered around a day of reckoning from at least three years of massive underinvestment in non-OPEC, non shale resources.

This took a while but the gyrations in the market in the last few months, the force majeure in Libya, the collapse in Venezuela and the not so subtle overtures from Donald Trump to OPEC and Saudi Arabia have all brought laser-sharp attention to the issue of the marginal barrel and spare capacity. Hint – there’s not a lot. While recent stats have shown a significant pickup in FIDs on new projects, many of these are years off in terms of completion. So we are in good shape for 2022, but for the next little bit expect a rough ride until Venezuela hits rock bottom and we learn how much spare capacity Saudi Arabia really has – note that we may never actually find out.

Despite arguments that shale will solve all and give the US energy independence, the evidenhce is all to the contrary. There is a growing concern regarding crude quality as light tight oil has a limited market and the Permian, as discussed here previously, has a major offtake issue – they need pipelines and this will constrain production growth. In addition, Mexico, Brazil, Southeast Asia and other key regions are underperforming their asset bases and beginning to show some of the effects of underinvestment. Mexico has new become a wildcard with the election of the socialist populist AMLO- what are his real plans for Pemex? Will he reverse the liberalization? Oil finds are still at decade lows, notwithstanding some promising developments in Africa and regardless of the amount of capital expended in the Permian, other oil needs to come on stream. When a power outage at a Suncor upgrader is enough to move global markets, you know things are tight. Such is the effect of surging global demand. Heck, even LNG markets are getting tight!

Grade B – Emerging

Fortunately, we have the cure for the demand side of the equation and, to a certain extent, the supply side as well residing in a drafty old white shack that Canadians have been accused on burning down just a short jaunt south of the border. I am referring of course to my worst forecast so far (I do have a ways to go), namely that I expected Donald Trump to be more “benign” in 2018 than the tumultuous year we saw in 2017. Nope. Couldn’t have been more wrong on that front. Continued belligerence on NAFTA, NATO spats and the whole G7 debacle have over the course of a few months resulted in a trade war with not just China but Europe and Canada as well. These trade conflicts are like a very aggressive cancer and will spread rapidly with varying unknown consequences, upsetting the benign economic conditions we have been enjoying, raising prices and inflation across the board and potentially stopping global growth in its tracks. But on the other hand, some steel mills in Pennsylvania can reopen so that’s good, right? Anyway, a big swing and a miss on this prediction, but then we are only half way through the year and mid-term elections are coming. Maybe the “average” will be right? One can only hope.

Grade F – needs work.

Production

Well, no matter how you slice this one, it’s safe to say that I nailed it. Even with the EIA revising its production numbers up at the end of the year by about 500,000 barrels per day and some softness in prices, the relentless push for production continues unabated in the US. I predicted the US would add some 750,000 to 1 million barrels per day of production and with 20k a week being added on average, it’s fair to say it will be in that range. Bring it on I say! The sooner we get those barrels in the market the sooner they are gone from the market. Frac on! Production at Dec 31 2017 was 9.782, current production is 10.900, although after year end, production was adjusted up be some 270,000 barels per day so the real starting number is somewhere above 10 million. With the current pipeline constraints in the Permian expect production growth to slow at least until all the Permian capital relocates to the Eagle Ford for a little renewed hype and production party.

Grade – A+

In Canada, I predicted a more modest growth in production – probably in the order of 250,000 to 300,000 bpd of oil coming from both oilsands and the conventional world. So far, so good.

OPEC production levels were forecast to be flat year over year unless the US started to get really out of control and so far, there is no reason to deviate from that prediction. Notwthstanding the recent agreement to add production after the June 22 meeting, the reality is that OPEC was simply replacing the barrels lost by Venezuela. It will be worth monitoring how much more capacity OPEC is going to add. Discipline is still there and it appears that some in OPEC are not as fussed by global supply issues as some politicians facing rising gas prices and mid-term elections might be. That said, the writing is on the wall, the theoretical cap on production may remain in place with unplanned outages but the OPEC + needs to produce more and they will.

Price of oil

This one is the kicker right? The glory call.

The call for this year was a year-end price of $72.34 and an average price for the year of $67.24. Actuals for the quarter are $74.15 as at June 29 and an average of $65.52.

So we’ve over shot the spot price but the average is looking pretty good. Unless Elon Musk starts delivering a whole bunch more cars or the entire SPR gets released into the market I feel good about this call.

Grade – B, because you just… never… know.

Price of Natural Gas

Ah natural gas, I can’t quit you! Natural gas has been disappointing me and pretty much all of Canada (on the producing side, consumers love this) with lousy pricing for the last two years if not an entire decade. Super cold winter, massive snow falls, larger than normal withdrawals from storage, nothing seems to be able to bring prices up. Why? Who knows. Certainly not me.

My year end price call for natural gas was $3.66 with an average price of $3.33. Actual June 29 price was $2.919 and the average was $2.840. And summer is here. It’s hot so lots of AC demand, but production growth shows no sign whatsoever of slowing. Whatever. There’s always the chance of an early winter right? RIGHT?

Grade D – need to do a way better job on natural gas pricing.

Activity Levels

I predicted 2018 activity in Canada was going to be flat compared with 2017 and the first half of the year certainly did nothing to dispel that impression. Soft gas prices, no LNG, uncertainty in BC and a general lack of enthusiasm for Canada in the investment community have held back activity, in particular in BC where activity levels have been surprisingly weak. As we emerge from spring breakup. I do hold out hope for strength in the second half of the year and am finely attuned to the first hint of an upward capex revision. Still too early to tell what is coming and who it will come from. Some oilsands and heavy oil projects are inching forward. Activity continues to be concentrated in the Montney/Duvernay and the Bakken and recent M&A point to a re-arranging of deck chairs. The CanPermian (East Duvernay) is getting a lot of media hype but isn’t on fire just yet. Service company M&A suggests a strategic positioning is happening and the negative sentiment is WAY overplayed. I actually feel a Canadian breakout may be happening.

Grade B – for being pessimistic, you get rewarded

US activity was expected to show quite robust growth and, well, Permania. Need I say more. In fact, I would say that I underestimated this drilling activity by probably 100 to 200 rigs. I did not predict the current plateau in rig count, but then my forecast didn’t appropriately account for the shipping issues being faced by Permian producers. Expect some rig count growth into the second half based on the forward curve, but not as smartly as earlier in the year – labour and materials are tighter, costs are rising, and the brace of DUC’s needs to be culled. However, cash continues to flow in unabated from Wall Street, notwithstanding pronouncements about “capital discipline” and all that jazz.

Grade C – this call was way too easy

M&A Activity

2018 was predicted by yours truly to be a robust year for energy M&A across the board. We are certainly seeing that in the E&P space in the Permian in particular (really? Quel surprise!) with some major deals and portfolio reshuffling happening as existing players double down on sweet spots and majors consolidate their positions. In Canada activity fairly muted earlier in the year as the black hole of the Permian continues to suck up all the spare investment interest and media coverage. However several notable deals on the service side by Mullen and CEDA and the Baytex deal were all consummated in the last month and should be viewed as leading indicators of where things are going.

Also predicted was a US return to Canada at some point – I will stick to that, but it may not happen until way later in the year.

Grade – C, lots of room for improvement

Canadian Dollar

We predicted strength for the Canadian dollar with the commodity price, but that headwinds such as the pending demise of NAFTA, trade disputes and the national carbon pricing strategy may hold it back. Great waffle prediction right? It could be good unless it’s bad. It’s actually bad. Really bad. The Canadian dollar is a mess, trading below $0.77 and likely to show no signs of life until this NAFTA gong show is resolved. No grade here – incomplete.

Infrastructure

So this of course is the one we all talk about – well here was the forecast: Keystone XL and TransMountain will make significant progress and there will be a positive LNG surprise before the year is out. I’m just going to let that sink in. Could it actually be? Well, we are waiting. I didn’t formally predict in December the Fed purchase of TransMountain but I made the call later and it was a good one. With TransMountain now happening and Line 3 approved and LNG Canada being all but an official FID, all we are left with is Keystone XL. TransCanada, what are you waiting for? You are invited to the party as well. Look, I know people hate pipelines. But you know what they hate more? High gas prices. And to reduce gas prices we need lots of gas. Which needs oil. Which requires pipelines. Which will be built. It’s happening.

Grade B+. It’s been a good run.

Stock Picks

OK, energy and energy related stocks have had a rough ride (at least my picks) for most of the first half of the year, but I’ve got some decent names, so how bad can it actually get?

Answer? Really bad.

So how do we look anyway?

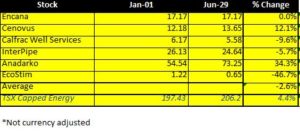

Overall the portfolio is down 2.6% and is behind its benchmark, which is up 4.4%. So underperformance – arg!!

Really only one of these guys has really crapped the bed – I’m looking at you Eco-Stim. What up with that? Might have something to do with it being basically an OTC stock but I digress.

Look, I’m willing to be patient here. How about you? I think this portfolio is well set up for the next few quarters and how about we all have a nice shout out to Anadarko, with a more than 30% return in the books. Well played!

Grade D – underperformance with nowhere to go but up? Sigh.

Overall Grade? C, it’s all a work in progress after 2 quarters.

Prices as at July 6th, 2018 (Jun 29, 2018)

- The price of oil was steady during the week as OPEC supply disruptions were offset by a tiny build in inventory at Cushing

- Storage posted a small increase

- Production was flat

- The rig count in the US was up

- After a larger than expected injection, natural gas gave up some ground then rallied thru the end of the week…

- WTI Crude: $73.80 ($74.15)

- Nymex Gas: $2.858 ($2.925)

- US/Canadian Dollar: $0.76400 ($ 0.76130)

Highlights

- As at June 29, 2018, US crude oil supplies were at 417.9 million barrels, a increase of 1.3 million barrels from the previous week and 85.0 million barrels below last year.

- The number of days oil supply in storage was 23.7 behind last year’s 29.4.

- Production stayed the same for the week at 10.900 million barrels per day. Production last year at the same time was 9.338 million barrels per day. The constant production this week came from constant production in Alaska and the Lower 48.

- Imports rose from 8.356 million barrels a day to 9.055 compared to 7.742 million barrels per day last year.

- Exports from the US fell to 2.336 million barrels a day from 3.000 last week and 0.768 a year ago

- Canadian exports to the US were 3.729 million barrels a day, up from 3.247

- Refinery inputs were up during the week at 17.653 million barrels a day

- <<No update this week – EIA don’t be so lazy!>> As at June 22, 2018, US natural gas in storage was 2.0074 billion cubic feet (Bcf), which is 20% lower than the 5-year average and about 26% less than last year’s level, following an implied net injection of 66 Bcf during the report week

- Overall U.S. natural gas consumption was up 1% during the report week

- Production for the week was up 1%. Imports from Canada were down 3% compared to the week before. Exports to Mexico were down 2% compared to the week before.

- LNG exports totalled 21.8 Bcf.

- Slowly but surely… As of July 6 the Canadian rig count was 182. Rig count for the same period last year was actually lower.

- US Onshore Oil rig count at June 29, 2018 was at 863, up 5 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was constant at 187.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was constant at 19

- Offshore rig count at January 1, 2015 was 55

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 62%/38%

Drillbits

- CEDA acquired Breakthrough Oilfield Services Ltd, a Dawson Creek, British Columbia-based industrial and field services company serving the oil and gas industry.

- Tariffs, tariffs, tariffs

- Trump Watch: EPA dude is out, turnover at the White House is now 61%! Russia Summit! Rocket Man!