Happy New Year everyone! It’s great to be back – refreshed and ready to tackle the raging bull that is going to be 2018. In fact, I am so confident in the future that I will say without hesitation that 2018 is going to be significantly better than 1918, which as we all know was the last year of World War I. But before we go there, time for THE RECKONING!!!!

That’s right, it’s that horrible time of year between the celebration of the holidays and the polishing up of a brand new Fearless Forecast where I have to come to terms with my typically failed prognostications delivered so innocently one year prior.

In many ways, forecasting and assessing results is a lot like the trench warfare that was the main strategy in World War I – a bludgeoning, bloody affair, punctuated by extended periods of boredom, poisonous gas and relentless shelling. In this particular case I am obviously referring to my overly optimistic call on natural gas prices which not even a CONTINENTAL DEEP FREEZE could deliver on. It’s awful really.

But, soldier on we must, so herewith a review. Not so pretty, but with a few startling highlights and inspired picks.

And as they say, wait ‘til next year!

Broad Themes

There were a few broad themes in the forecast that were designed to be easy to pick and less easy to critique.

First of these was a prediction that the popu-nationalism that gave rise to Trump and Brexit would in fact crest and fade over the year.

Did it actually? It’s hard to say. The signs are all over the place and the noise in the world being caused by the Trump administration and its bull in a china shop approach to diplomacy is obscuring some significant moves on the progressive front. Europe remains a place where the progressive ideal hangs on, at least in the Nordic countries, France and Germany – Eastern Europe not so much… Meanwhile Brexit negotiations continue, Saudi Arabia continues to liberalize its human rights (women are now allowed to attend sporting events!) and Iran is going through one its occasional demand for freedom spasms, which of course will be ruthlessly crushed, but at least it lets arm chair progressives support the revolution. On the other hand, Saudi Arabia is crushing Yemen, Iranian influence is spreading. Russia and China are much more focused on themselves and, of course, the Little Rocket Man now has a button, as does agent Orange.

Trade was another front where we expected some movement and instead all we got was meaningless NAFTA discussions with a US government seemingly intent on scuttling the deal, just because.

The rapprochement with Russia is still a work in progress, although as noted previously not between the United States and Russia, but rather Russia and the Middle East. Strange bedfellows but the oil price rally will certainly help subsidize Russian interventionism is the region.

Turkey was my global flashpoint given its historic position as the intersection of cultures. But so far it has been North Korea stealing the show. Who knew the Hermit Kingdom would dominate so much of the conversation what with all those missiles and nuclear tests. That said, Turkey still has a Kurdish problem that isn’t going away – keep an eye on this region.

The final theme was the “cresting” of the green wave and how the Trump election was a disaster for the environmental movement. As noted before, this is certainly the case in the United States where the green movement is increasingly pushed off the front page, development continues roaring ahead and it seems a day can’t go by without some other region of the United States being opened up to oil and gas drilling – why just the other day, fracking bans were lifted in Central Park of all places!

In the meantime, the rest of the world continues to push ahead (in speeches at least) with the Paris Accord emissions reductions and the results are already starting to be felt with super cold weather in New York over New Year’s showing the Global Warming can and has been beaten. Wait – no, that was just a local point in time event, not a trend so… not yet.

In all reality, it is hard to get a read on where the environmental movement is. In Canada, it is alive and well but much less strident lately. In the US, it seems to have disappeared. In Europe, it is as it ever was and in the rest of the world it never stood a chance. But at least China is looking at electric vehicles.

Broad Theme Grade – C. Why? It just didn’t pan out as expected. Does it ever?

Production

First call was that OPEC/NOPEC would meet their production cuts and indeed they continue to do so. Compliance is consistently high. Yay for me!

Non-OPEC production was expected to be flat year over year and that is likely the case.

With an initial prediction of the US adding only 300 to 400 thousand barrels a day of production in 2017, I was proved wrong quickly out of the gate. With some analysts calling for a 1.2 million barrel increase, I was definitely on the low side as the rig count grew aggressively. However the rig count plateaued in December and the rising DUC numbers show what a challenge it was to complete wells. That said, completions rose from about 600 a month early in the year to close to 1,000 a month at the end and production numbers followed suit. I had raised my top end to 600,000 barrels a day in March and even that was light. According the EIA, the year over year growth was just over 1 million barrels per day which is pretty impressive. I admit complete defeat on this one, the rig count recovered way faster than anticipated and I failed to account for sizable offshore additions to production. That’s a F verging on an F!

Canadian production was expected to post modest growth as well. At December 31, 2016 Canadian production of crude and condensate was 4.156 million bpd and at December 20, 2017 the NEB estimated that it will close the year at 4.430. Consensus had Canada growing by about 400,000 bpd this year, currently looking to be just around 300,000 bpd – pretty close and meets the measure of “modest”. The grade is a B+.

Price of oil

As many of you are aware, I adjusted my oil price forecast on the fly (why? Because I can, that’s why) and targeted a new year end price of $56 instead of $65 and a trading range between $45 and $55. I didn’t pick a revised average price, but for fun decided to say $48.97.

Then of course OPEC renewed and the protests in Iran started up and lo and behold…

As of December 31, the price of oil was $60.42 and the average price for the year to date was $50.86. The high for the year was $60.42 and the low was $42.53. Grade for the year is a solid B+. I am actually quite happy with how this turned out, but not enough there to give me an A.

Price of Natural Gas

I am probably the only person in North America who still believes we are soon going to see a rally in natural gas prices. I just think the drilling activity hasn’t been there and the export market growth combined with the increased usage in industrial and electricity end user markets have to eventually take their toll on pricing. But we’re still waiting. Comparative inventory is declining, stocks are below the five year average, but prices sit in the proverbial port-a-potty.

My prediction that gas would be a key commodity this year is looking, well, about as smart as a bag of hammers but I still believe in the gas story long term..

My year end prediction was $4.50. My average price was $3.50.

I did not revise my forecast so I have to stick with what I picked. So be it!

Price at December 31 was $2.953 and the average for the year was $3.019. Gas traded as low as $2.60 towards the end of the year as the whole country froze and supplies were tight. I have no explanation for the big miss, but it was a whopper.

Grade is a D- because prices are currently rallying above the $3 range, but that’s only because I feel sorry for myself.

Activity Levels

I predicted a robust 2017 in Canada with activity concentrated in a barbell fashion – Montney/Duvernay/Viking and then quiet all the way to the Bakken with the activity happening in Q1 2017 and resuming later in the summer. The first quarter was bang on and these areas were super busy. My prediction was based on number of wells drilled so still too early to tell. But given current levels of activity are way ahead of last year and CAPP, PSAC and CAODC have all revised their projections upward, I’m thinking we are looking OK. Plus the whole year unfolded as expected, so yeah. Not bad.

US activity was expected to show quite robust growth and, well, Permania. Need I say more. In fact, I would say that I underestimated this drilling activity by probably 100 to 200 rigs – which of course is reflected in my miss on production. I did not predict the current plateau in rig count, but then my commodity forecast was initially a bit more aggressive. Expect some rig count growth into the new year based on the forward curve, but not as smartly as the same period last year – capital and materials are scarcer, and the brace of DUC’s needs to be culled.

Grade B. Directionally right for North America, close for Canada, underestimated the US.

M&A Activity

I predicted for the year that M&A activity would pick up, definitely in the service sector and to a lesser extent in the E&P world until later in the year when I expected a rebound.

Returns for the year are spotty, a big flurry of upstream deals early on as the exodus from Canada gathered steam and then relatively quiet for the balance of the year with a few deals off and on in the Permian. On the flip side, IPO activity was fairly active. It feels like there is a lot of pent up demand and I fully expect that 2018 will tell a different story.

Grade – C. Right call on increased activity but outside of a few major transactions, the scale left a bit to be desired.

Canadian Dollar

My call was for the dollar to trade around 75 cents for much of the year – held back by lower oil prices and US Fed rate hikes. Then the Bank of Canada happened and the economy grew and oil came back and what do you know – a reasonable pop in the loonie! At year end, the loon was on a glide path at $0.7959. Oops in a good way.

Note too that I did say a rally in oil could bring us closer to 80 cents, and that that level was still possible by the end of the year, so I’m going to pat myself on the back (pat pat).

Grade: A-. Because I was mostly right.

Infrastructure

I do not even know what to say anymore.

Grade: DNQ.

Stock Picks

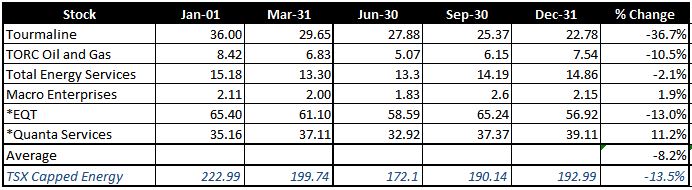

OK, energy and energy related stocks have been eviscerated for most of the year, but I’ve got some decent names, so how bad can it actually get?

Answer? Really bad. Tourmaline, how could you? You were supposed to be the gas weighted star?

So how do we look anyway?

Overall the portfolio is down 8.2% but is ahead of its benchmark, which is down 13.5%. So outperformance – yay!

But some of these guys really crapped the bed – like Tourmaline? What up with that?

Without Tourmaline the return would have been closer to -2%. I say again – Tourmaline, you were my favourite – what happened???? However, there is only one person writing this blog who went heavy on natural gas, both on the producer side (Tourmaline and EQT) and the infrastructure side (Macro) so the blame is squarely on my shoulders.

Grade C – out performance, but still losing money

Overall Grade for the year? I can’t give it more than a C, no one aces their forecast by calling the Canadian dollar to trade at its long run average.

Although on the oil price, I was a veritable wizard…

Next year! Wait til next year!

Preview – more oil price appreciation and, dare I say it, a natural gas price rally.

Prices as at January 5, 2018 (December 22, 2017)

- The price of oil continues to show strength on Iranian protests and big inventory draws.

- Storage posted big decrease

- Production was up marginally

- The rig count in the US was up by a rounding error

- Natural gas keeps trying to rally – primarily on weather – c’mon gas, we need you!

- WTI Crude: $61.55 ($58.47)

- Nymex Gas: $2.790 ($2.667)

- US/Canadian Dollar: $0.8062 ($ 0.7871)

Highlights

- As at December 29, 2017, US crude oil supplies were at 424.5 million barrels, a decrease of 7.4 million barrels from the previous week and 54.5 million barrels below last year.

- The number of days oil supply in storage was 24.6 behind last year’s 28.9.

- Production was up for the week by 28,000 barrels a day at 9.782 million barrels per day. Production last year at the same time was 8.770 million barrels per day. The change in production this week came from an increase in Alaska deliveries and a rise in Lower 48 production.

- Imports fell from 7.993 million barrels a day to 7.966 compared to 7.183 million barrels per day last year.

- Exports from the US rose to 1.475 million barrels a day from 1.210 and 0.686 a year ago

- Canadian exports to the US were 3.524 million barrels a day, up from 3.328

- Refinery inputs were up during the week at 17.608 million barrels a day

- As at December 29, 2017, US natural gas in storage was 3.126 billion cubic feet (Bcf), which is 6% lower than the 5-year average and about 6% less than last year’s level, following an implied net withdrawal of 206 Bcf during the report week.

- Overall U.S. natural gas consumption was up 26% during the week, influenced by increases across all sectors and warmer weather, hitting an all-time high on January 1 2018 (someone tell prices!)

- Production for the week was down 4%. Imports from Canada were up 32% compared to the week before. Exports to Mexico were down 5%.

- LNG exports totalled 15.2 Bcf.

- As of January 1 the Canadian rig count was 186 – 138 Alberta, 20 BC, 28 Saskatchewan, 0 Manitoba. Rig count for the same period last year was about 200. Expect the rig count to appreciate significantly into the winter.

- US Onshore Oil rig count at January 5 was at 742, down 5 from the week prior.

- Peak rig count was October 10, 2014 at 1,609

- Natural gas rigs drilling in the United States was flat at 182.

- Peak rig count before the downturn was November 11, 2014 at 356 (note the actual peak gas rig count was 1,606 on August 29, 2008)

- Offshore rig count was down 1 at 17

- Offshore rig count at January 1, 2015 was 55

- US split of Oil vs Gas rigs is 80%/20%, in Canada the split is 56%/44%

Drillbits

- Alberta’s carbon levy increased on January 1 2018 by $10 a tonne or 50%. I have no opinion on the matter. That hasn’t been expressed in frustration at any point in the last year at least.

- In the first announced deal of a forecast robust 2018, Vertexz Resources acquired Sonic Oilfield Services, a fluid solutions provider operating mainly in Saskatchewan

- Trump Watch: There is a new book out about the Trump White House and it promises to be a barn burner – lawsuits are already pending! And for those of you who follow Twitter and have been reading excerpts, Donald Trump does NOT have a customized gorilla channel showing only gorilla fights. And yes, it fooled me too.